Fraud Risk Management

Mitigate risk at every stage of the transaction lifecycle with real-time insights and automated alerts.

Mule Monitoring Intelligence

Prevent mule-driven lending fraud by scoring and profiling applicants before disbursement.

Case Management Dashboard

Real-Time Visibility

View open, closed, or escalated cases across merchants and agents.

Drill-Down Details

Access intelligence such as involved entities, rule violations, and compliance actions taken.

Report Generation

Download detailed Open/Close Case reports (CSV/PDF) or set up automated email delivery for stakeholders.

Escalations

Enable quick case routing to compliance or regulatory teams for resolution.

Suspicious Transaction Reporting

-

Auto-Triggered STRs: Generated based on predefined rules such as large transaction spikes or cross-border anomalies.

-

Regulatory Format Compliance: STR templates built in accordance with FIU-IND and RBI requirements.

-

XML Response Integration: Receive acknowledgement and XML responses from regulatory systems directly in the dashboard.

-

Submission Tracking: Track STR progress and follow-ups from a centralized panel

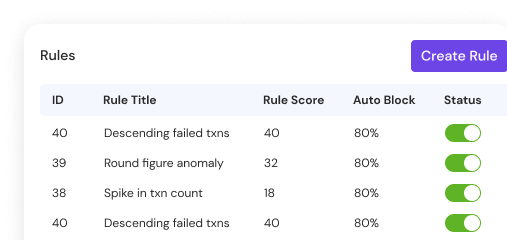

Rule Engine & Violations Analytics

Rule Management

Create, modify, and activate/deactivate rules across risk categories (e.g., KYC breaches, transaction anomalies).

Sandbox Testing

Validate new rules in a non-production environment to minimize false positives.

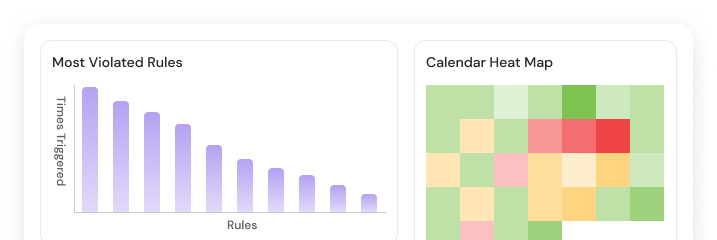

Violation Analytics

Visualise repeated violations through heatmaps, trend charts, and aggregated reports.

Red-Flagged Entities

Automatically list high-risk merchants with risk scores and historical violation data.

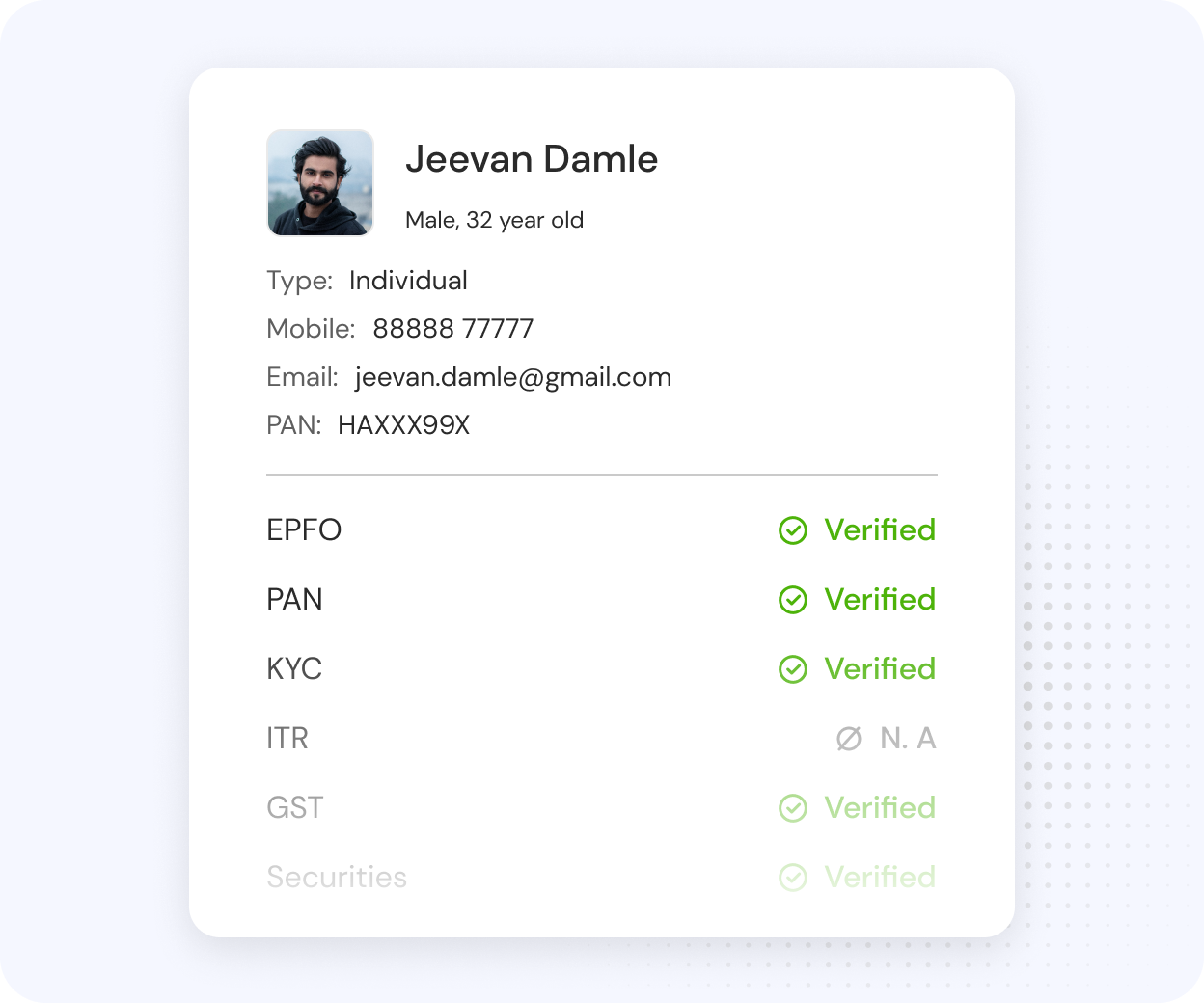

Merchant & Borrower 360° Risk View

-

GMV Tracking: Monitor Gross Merchandise Value trends and associate them with fraud patterns.

-

MCC Mapping: Review Merchant Category Codes with risk correlation by sector.

-

Transaction Analytics: Access latest transaction summaries and anomaly flags.

-

Onboarding Profile: Display the merchant’s KYC/AML verification status, document trail, and compliance score.

Customization & Intelligence Layers

-

Custom Rule Creator: Build dynamic, no-code rule sets with thresholds, triggers, and notifications.

-

Automated Compliance Workflows: Auto-block or escalate cases when rule-defined thresholds are breached.

-

Merchant Risk Scoring: Continuously update merchant risk profiles in real time using transaction and rule analytics.

-

Behavioral Analysis Engine: Detect identity misuse or transactional pattern shifts indicative of fraud.

Data Ecosystem

Easebuzz NBFC Stack

Frequently Asked Questions

Easebuzz’s FRM platform uses a combination of rule-based engines and machine learning algorithms to continuously monitor transactions for suspicious patterns, such as unusual amounts, velocity, or cross-border anomalies. Suspicious activities trigger instant alerts and can be escalated for investigation, ensuring rapid response to potential fraud.

Yes, the platform automatically compiles and generates STRs based on predefined regulatory templates. These reports are compliant with RBI and FIU-IND guidelines, and users can also download XML responses from regulatory authorities for audit and compliance tracking.

Easebuzz’s Mule Detection uses profile-based underwriting intelligence and behavioral scoring to identify high-risk borrowers and potential mule accounts. It assigns a fraud risk score (0–1000) and flags suspicious profiles, helping lenders prevent fraudulent loan disbursals and reduce portfolio risk.

The platform offers customizable case and violation reports, which can be filtered by merchant, rule type, and timeframe. Reports can be exported to CSV or PDF and scheduled for automated delivery to compliance teams. Advanced analytics include heatmaps, trend charts, and risk scoring for merchants and transactions.

Easebuzz’s FRM & Mule Monitoring platform is API-first and modular, allowing seamless integration with core banking systems, loan origination platforms, and payment gateways. It supports real-time data ingestion and enrichment from multiple sources, making it adaptable for both legacy and modern digital infrastructures.