Trusted payments platform in India for leading brands

Make customer purchases affordable

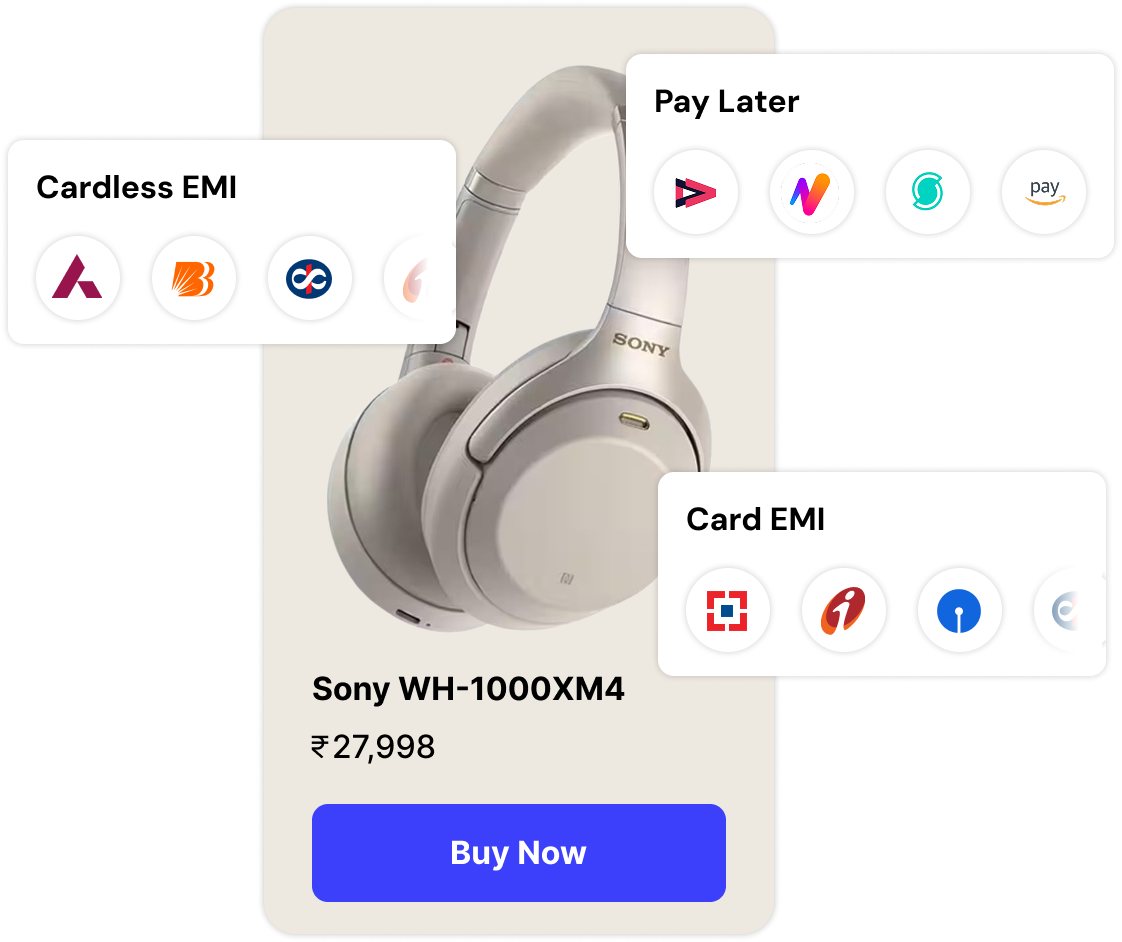

With Easebuzz Affordability Suite, merchants can drive sales and attract customers by offering low-cost payment instruments with flexible EMIs through partnered Banks and NBFCs. By enabling flexible credit solutions, businesses can drive higher-value transactions, reduce drop-offs through affordability, and enhance customer trust.

Make your products more affordable by reducing the upfront payment amount. Available across 15+ banks.

100% Digital EMIs, no need of Credit or Debit cards. Enable access to EMIs for a large segment of consumers who do not have access to a credit card

Make your products more affordable for broader Indian consumers. Enable access to EMIs for Debit card users and increase penetration across Tier 2 and Tier 3 towns

Empower customers to buy products during the checkout process and offer the flexibility to pay later using BNPL facility

Delight your customers through No Cost EMI on credit cards on the checkout page.

Why Choose Easebuzz Affordability Suite?

-

Increase Sales

Offer EMIs and credit solutions to attract more customers, boost conversions, and drive higher transaction values.

-

Enhance Customer Loyalty

Seamless EMI options encourage repeat purchases and build long-term customer relationships.

-

Reduce Checkout Drop-offs

Provide accessible credit and EMI options, making high-value purchases more affordable and reducing cart abandonment.

-

Integrated Discounts & Rewards

Offer built-in cashback, discounts, and referral-based incentives to enhance customer engagement and drive conversions.

-

Seamless Integration via QR code

Easily enable affordability solutions with QR code scan and provide customers with affordable options.

-

Better Cash flow

Get upfront settlements while customers pay in installments, ensuring stable cash flow and financial predictability.

Key Benefits to Merchants

-

Increase Sales

Empower customers to purchase higher-value products

-

Boost Customer Confidence

Financial tools help customers manage budgets, encouraging more spending

-

Streamline Checkout

Integrate deals, discounts, and rewards seamlessly at the point of purchase

Industries We Empower

Partnerships That Deliver Excellence

Easebuzz partners with top NBFCs to offer innovative financial solutions for merchants at their checkout page.

A trusted NBFC offering innovative lending solutions tailored to modern consumer needs.

-

Educational institutions must provide details such as Trust Name, Affiliation Code, Course Fees, and Student Numbers.

-

Loan range: ₹25,000 - ₹5,00,000 | Tenure: 3-24 months.

An industry leader in instant personal loans and flexible EMI options.

-

Businesses need an Easebuzz ID, MCC Code, and basic entity details.

-

Loan range: ₹1,000 - ₹2,00,000 | Tenure: up to 12 months.

A dynamic platform enhancing financial accessibility for eCommerce businesses.

-

Provide GST ID, Business PAN, and store details.

-

Loan range: ₹3,000 - ₹5,00,000 (varies by partner bank) | Tenure: 3-36 months.

Why choose Easebuzz Payments Platform?

-

Faster Merchant Onboarding

-

100% Compliant & Secure

-

150+ Payment Options

-

24x7 Technical Support

What our customers say about us

Our experience with Easebuzz payment gateway has been excellent and it helped us with 4 times improvement in our payment success rates. Earlier, we used to face payment reconciliation issues, which have been resolved with Easebuzz platform’s auto reconciliation feature.

Tanya Saigal

Customer Experience

M2M Ferries

We are very happy with Easebuzz services and find it easy-to-use not only from a business perspective but also from a developer's point of view. We look forward to taking this partnership further.

Abhishek Kumar

Founder, Director

docOPD

The best part about the Easebuzz API solution is their smooth onboarding process that automates the procedure including underwriting, making it effortless. Products from the Easebuzz payment solution suite including Slices and FeesBuzz have helped us in collecting payments with no fuss.

Anupam Jeevan

Director

Dexpert Solutions

Frequently Asked Questions

The Easebuzz Affordability Suite offers flexible financing solutions, including EMIs, PayLater, and cardless credit, making purchases more accessible for customers while driving higher sales for businesses.

It helps attract more customers, increases average order value, reduces checkout drop-offs, ensures upfront payouts, and enhances customer loyalty through easy financing options.

We offer Credit Card EMIs, Debit Card EMIs, Cardless EMIs, PayLater, and No-Cost EMI through our partnered Banks and NBFCs.

Easebuzz has partnered with leading NBFCs like Fibe, Cashe, and ShopSe - HDFC, ICICI, KOTAK, etc., to provide consumers with seamless credit and EMI options.

Merchants can activate affordability solutions through Easebuzz by integrating our checkout system and completing a simple onboarding process.

The Cardless EMI option, which allows customers to get EMIs without a credit or debit card, depends on the NBFC's and Bank's processing, specific criteria, and the amount. Digital KYC makes this financing option more accessible.

Merchants receive upfront payments for purchases made via credit or EMI options, while customers pay in installments over time.

Yes, merchants can offer No-Cost EMI, allowing customers to split payments without additional interest, improving affordability.

Easebuzz provides a quick and seamless setup with minimal integration efforts. Contact our team for pricing and details.