Trusted payments platform in India for leading brands

KYC Verification platform tailored to meet new-age business needs

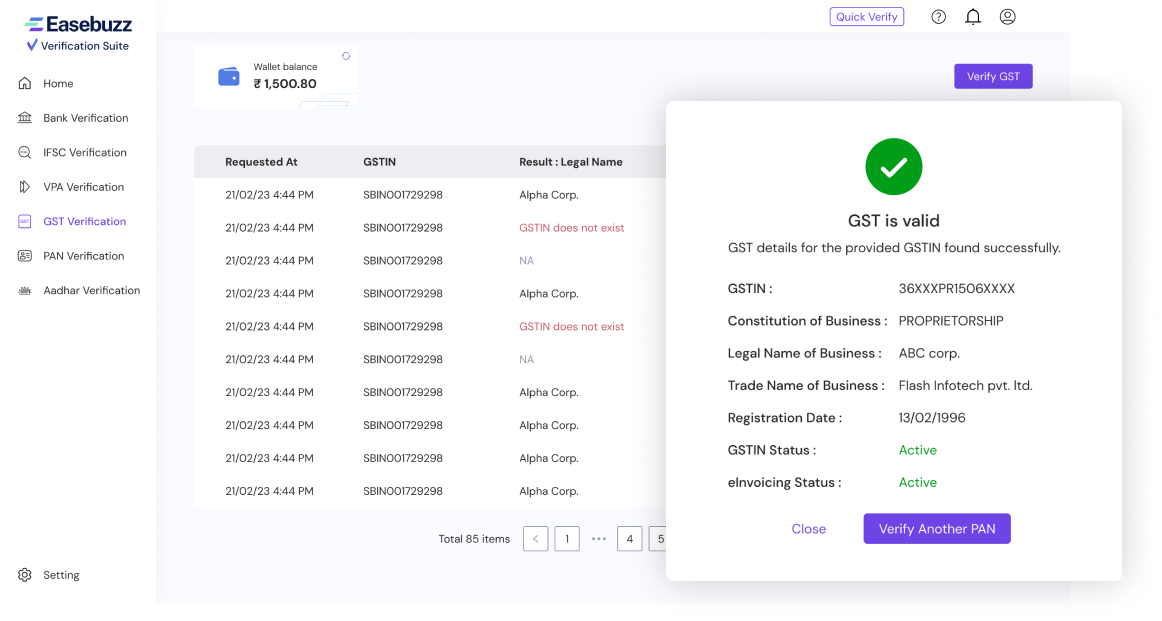

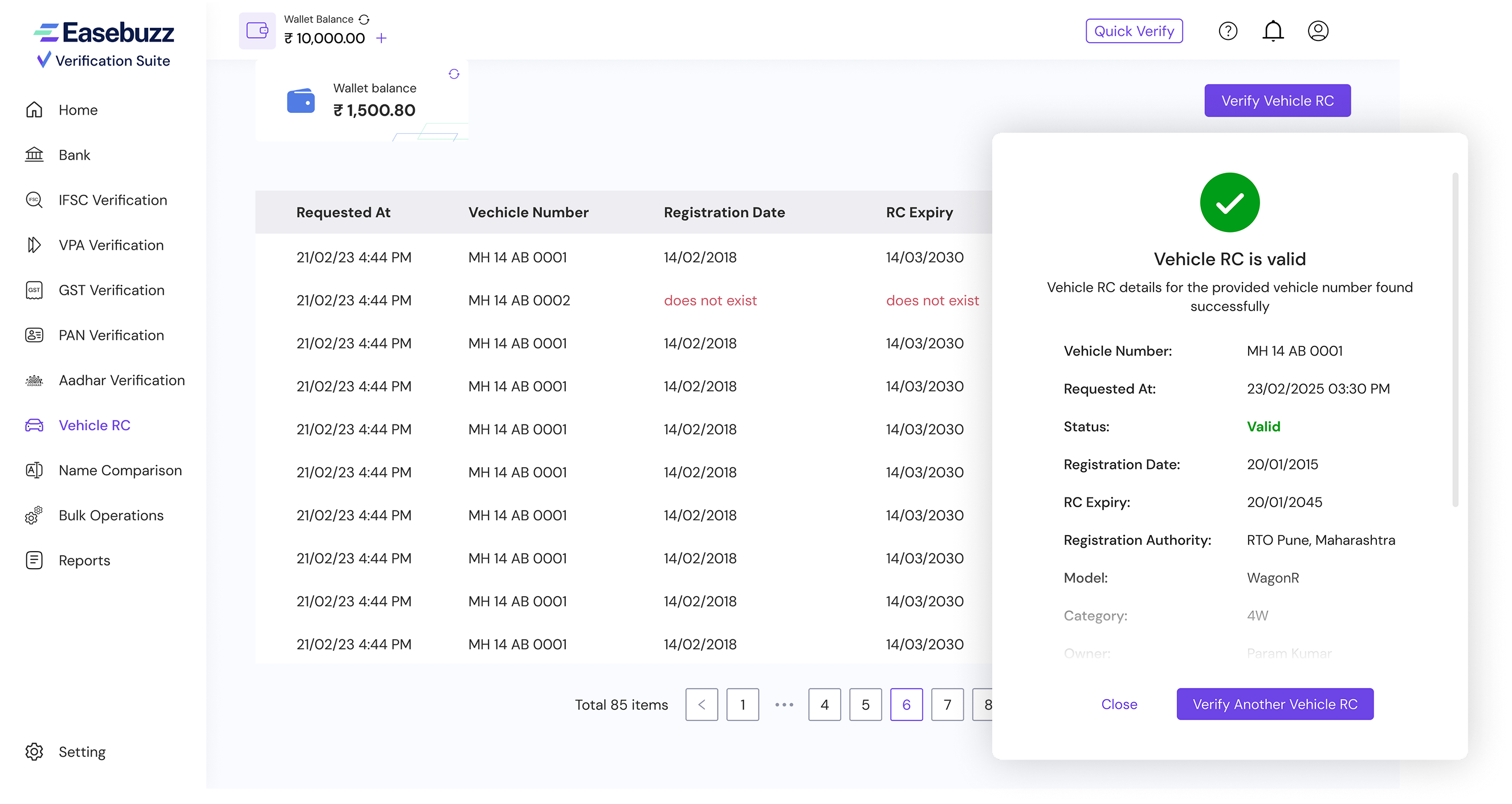

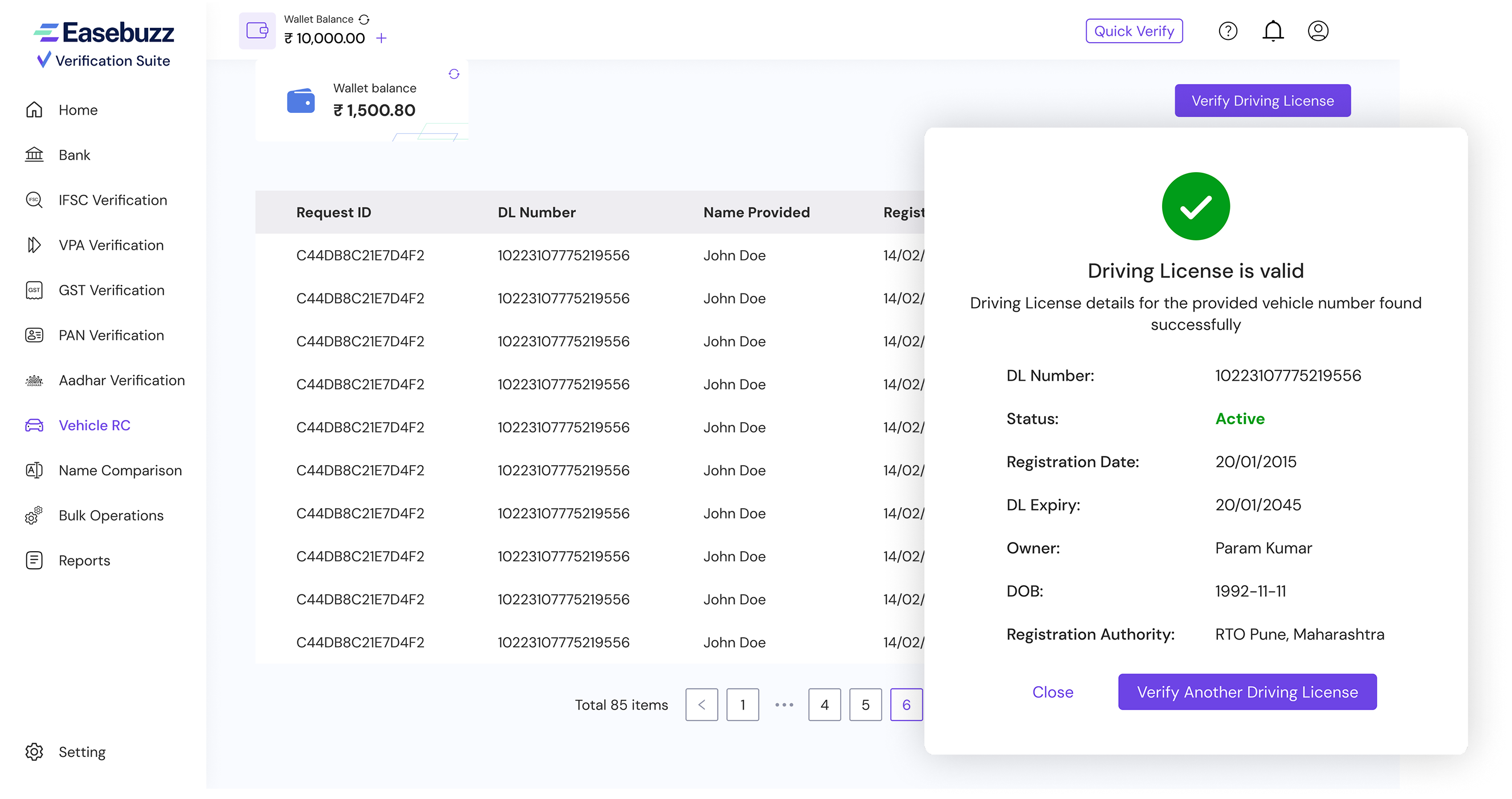

Easebuzz Verification Suite is a KYC verification platform that provides instant and accurate verification of customer details, including Bank Account, VPA, GSTIN, PAN Driving License and Vehicle RC details checks. Seamlessly integrates with banking networks, NPCI, and government data stacks, it automates data checks, reduces errors, and speeds up onboarding and payouts. With real-time insights and scalable risk management, it ensures both operational efficiency and enhanced security.

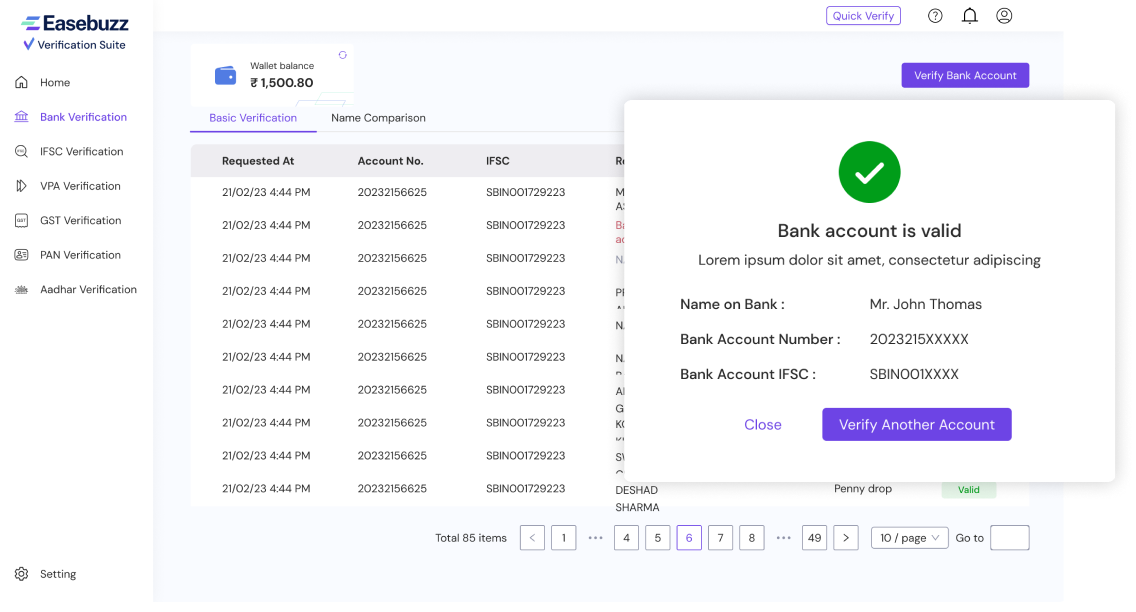

Automate real-time validation of bank details through Penny Drop and Penniless verification options, ensuring payments reach the correct beneficiaries without delay.

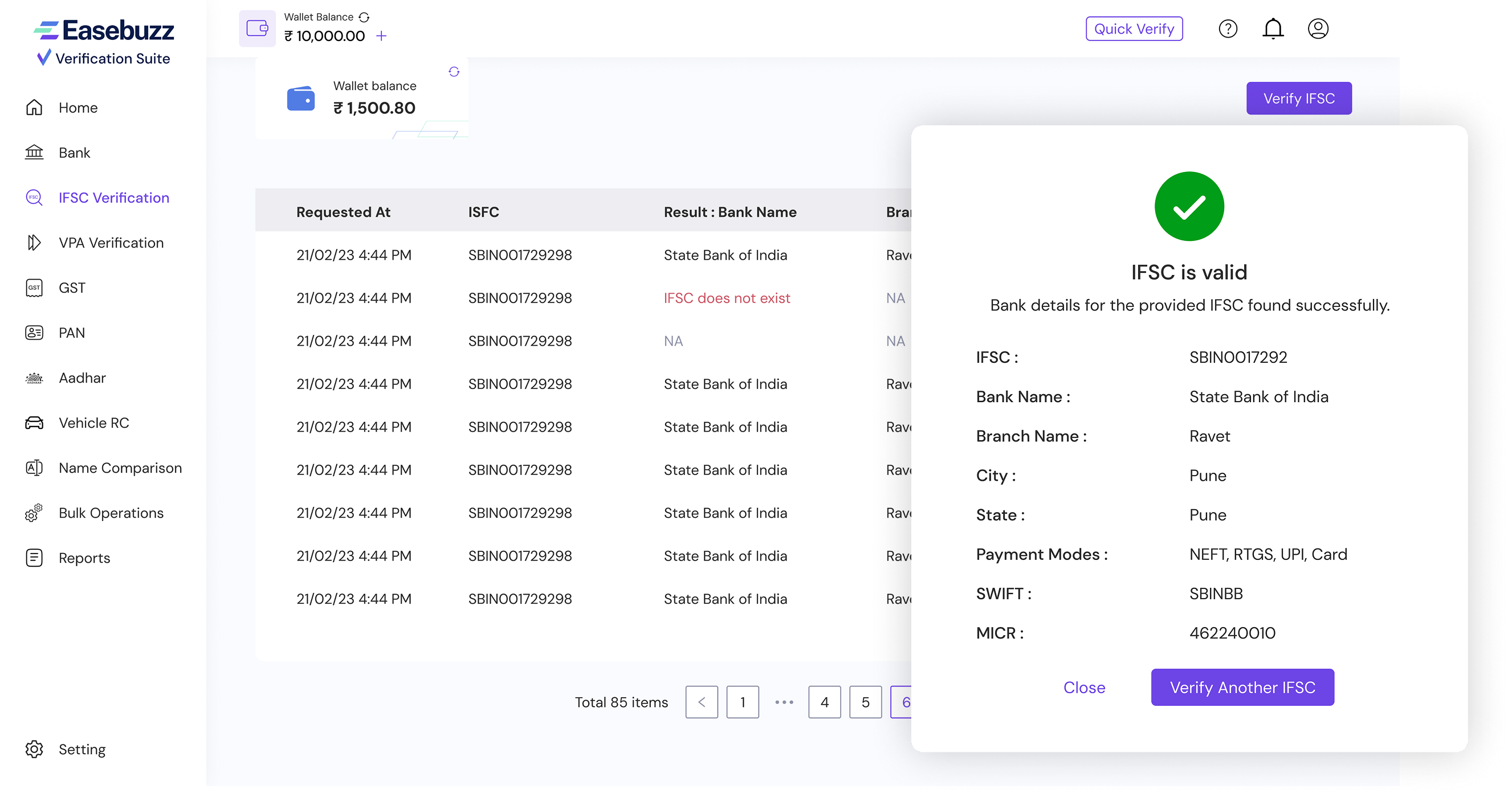

Validate beneficiary bank branch details with IFSC codes, eliminating transfer discrepancies.

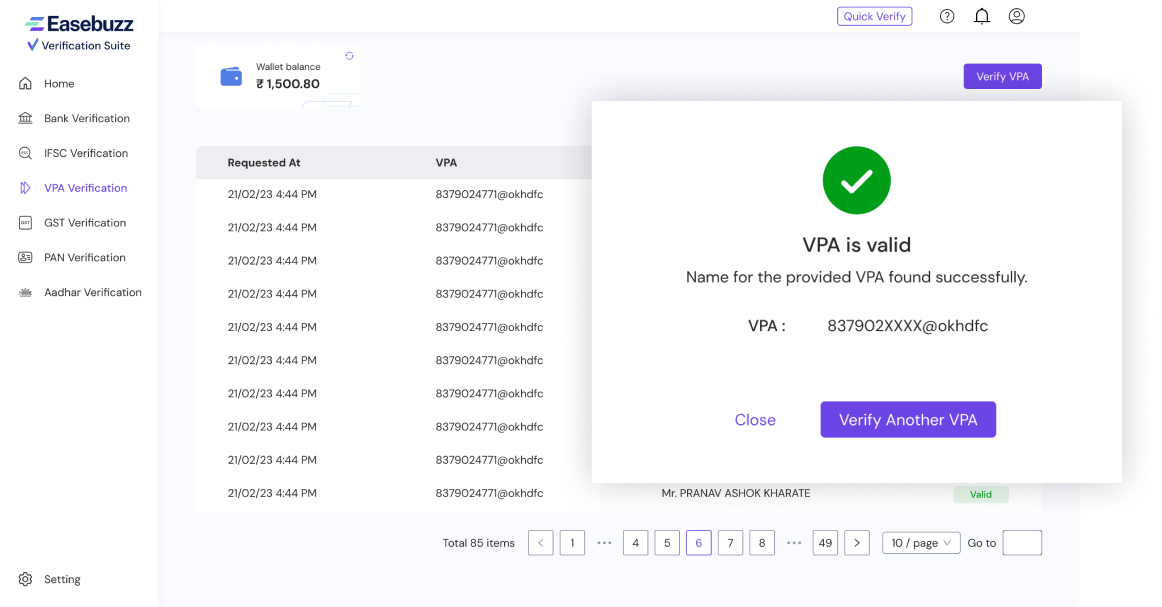

Instantly verify Virtual Payment Addresses (VPAs) for secure UPI-based transactions, enhancing transaction safety and efficiency.

Authenticate PAN details to ensure regulatory compliance and verify business legitimacy.

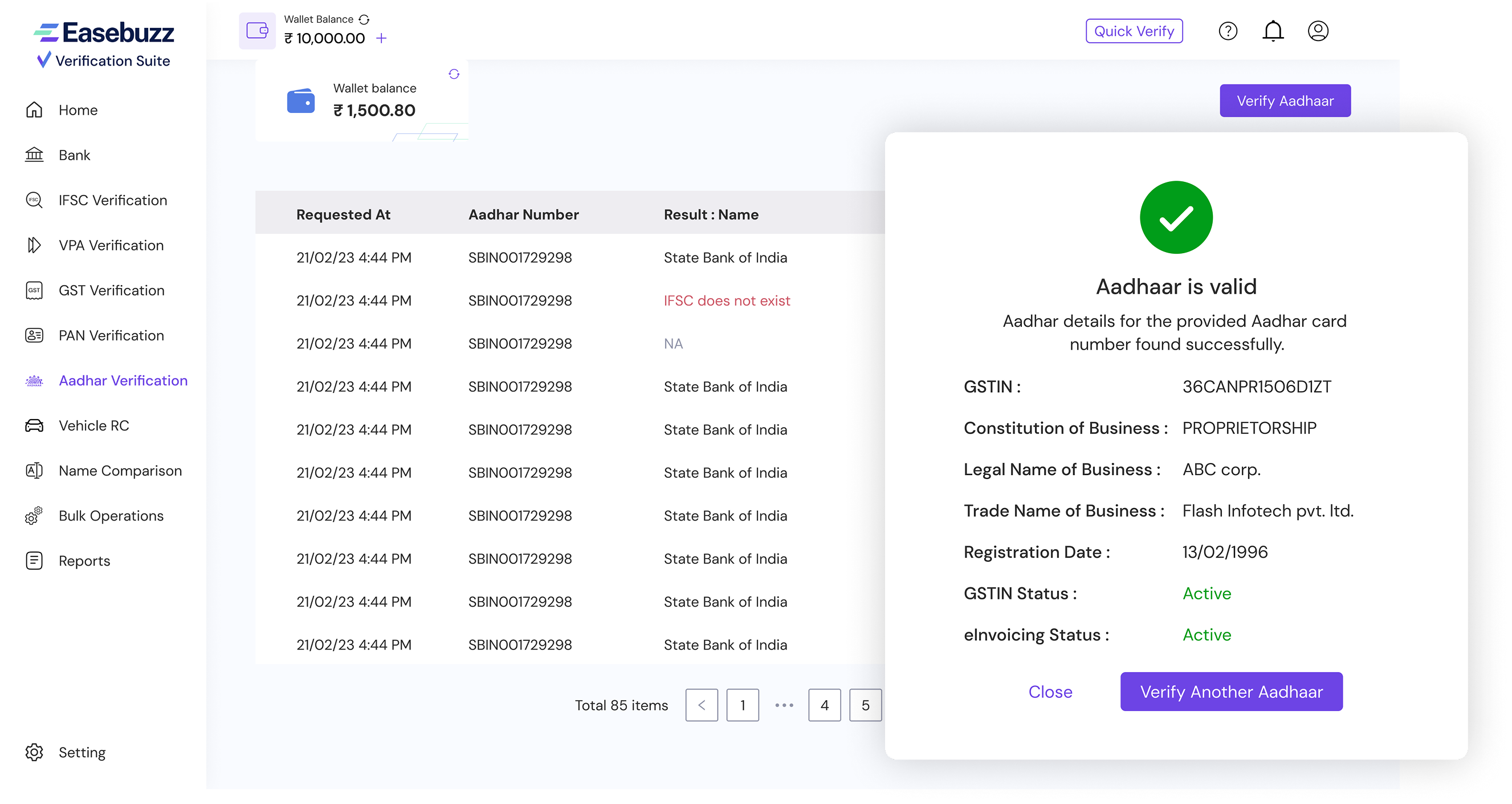

Validate Aadhaar details to simplify KYC processes, onboarding, and payout operations efficiently.

Ensure the legitimacy of business GSTIN checks.

Authenticate vehicle registration numbers and ownership details in real time with industry-leading accuracy.

Streamline user identity checks during onboarding and background verification processes.

Benefits of Easebuzz Verification Suite

-

Real-Time Processing

Get instant results across all verifications for prompt decision-making and transaction processing

-

User-Friendly Interface

Designed for easy use, with clear instructions and real-time status updates for effortless management

-

Secure Data Handling

Robust security protocols to ensure compliance with data protection regulations and prevent fraud

-

Seamless Integration

Integrate APIs with ERP platforms and support high TPS handling up to 20 million daily requests

-

No-Code Platform

Self-serve dashboard to perform real-time verifications without needing extensive technical setup

-

Bulk Verification

Conduct single or bulk verifications through simple Excel uploads or API integrations for maximum flexibility

Effortless verification & real-time insights

With the Easebuzz Verification Suite, businesses gain a one-stop solution to streamline all verification needs with high scalability and 100% uptime. Robust APIs, real-time insights, and built-in approval flows.

-

NBFCs & Fintechs

Simply KYC verifications of borrowers and partners during onboarding to ensure compliance and accelerate loan disbursals

-

Insurance

Validate policyholder and corporate customer details, streamlining claim settlements while reducing fraud risks

-

Education

Authenticate student identities quickly for secure onboarding and faculty bank account verification salary processing

-

E-commerce

Verify vendor bank accounts and tax details to simplify onboarding and payouts

-

Travel and Hospitality

Checks bank details and GSTINs of delivery agents and fleet partners, ensuring seamless commission payments

-

Retail and FMCG

Authenticate vendor and distributor details, ensuring accurate payouts and supply chain compliance

-

Real Estate and Construction

Simplify contractor and tenant verification, enabling smooth transactions and accurate payouts

-

Staffing Agencies & HR Platforms

Manage staff, workers' & employees' verification before payments with secure bank account validation & identity checks

-

B2B SaaS Companies

Supports B2B SaaS platforms by authenticating business bank accounts, GSTINs, and PAN for recurring payments

Why choose Easebuzz Payments Platform?

-

Faster Merchant Onboarding

-

100% Compliance & Secure

-

150+ payment Instruments

-

24*7 technical support

Frequently Asked Questions

Easebuzz Verification Suite is a comprehensive platform that automates the verification of critical customer and partner details, including bank accounts, UPI handles (VPAs), GSTINs, and PANs, ensuring secure transactions and compliance with regulatory standards.

Easebuzz supports Bank Account Verification (via Penny Drop and Penniless methods), VPA (UPI Handle) Verification, GSTIN Verification, and PAN Verification, offering real-time and accurate results for streamlined onboarding and payouts.

Yes, Easebuzz supports both single and bulk verifications through API integrations or simple Excel uploads, making it ideal for businesses requiring high-volume data authentication.

By automating verifications, Easebuzz reduces manual errors, accelerates onboarding and payouts, enhances fraud prevention, ensures tax compliance, and delivers operational efficiency with real-time insights and secure data handling.

Yes, Easebuzz provides robust APIs and a user-friendly interface for seamless integration into your existing systems, ensuring smooth implementation and scalability for growing demands.

Industries like NBFCs, Insurance, E-commerce, Logistics, Education, Healthcare, Retail, Real Estate, Staffing & HR platforms, and B2B SaaS platforms can leverage Easebuzz for secure onboarding and payouts.

Easebuzz adheres to strict data protection regulations and industry standards, implementing robust security measures to safeguard sensitive information while maintaining full compliance with regulatory requirements.