Trusted by India’s leading brands

Streamline postpaid bills and recurring payment collections

Easebuzz Bill Payment System simplifies bill payment acceptance for various service providers like housing societies, eMeters, ISPs, travel, education, insurance, gyms, hotels, etc. Enable their customers to fetch their bills and make payments online via 150+ payment modes with real-time payment confirmations and secure infrastructure compliance with RBI regulations.

-

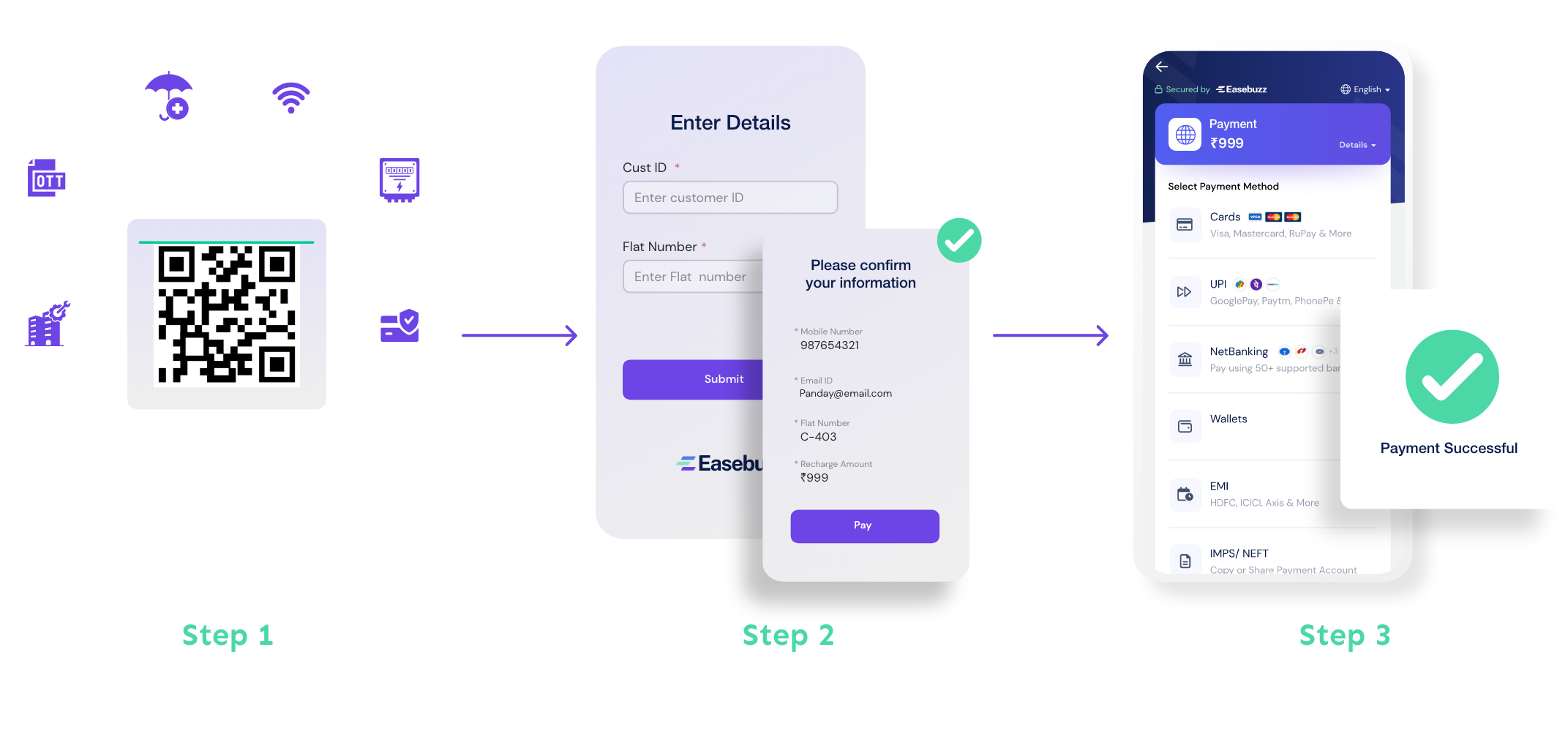

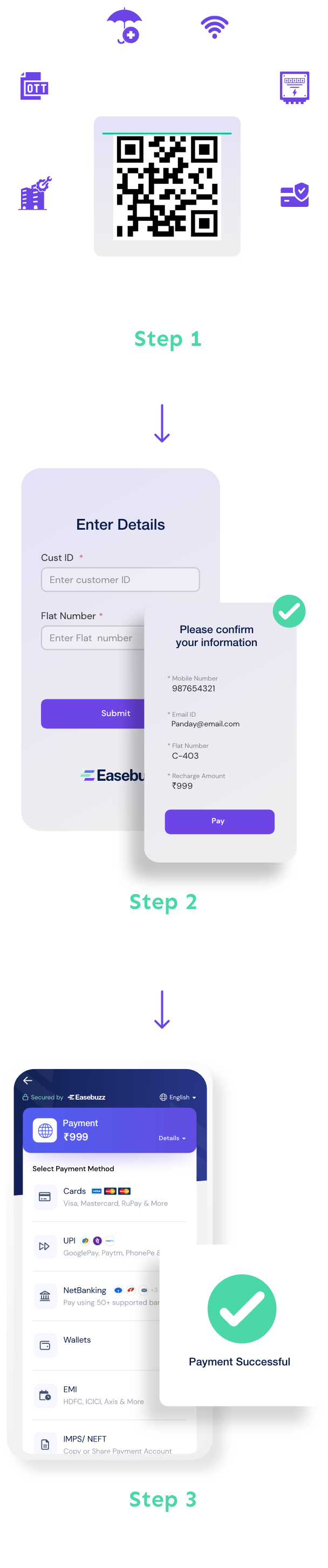

Quick Access via QR & Links

Accessible through static QR codes or links sent via SMS and email, compatible with mobile and web browsers

-

Smart Form for Verification

Verifies unique customer credentials (bill number, flat number) through secure integration with third-party systems to fetch customer details

-

Secure Payment Options

Offers 150+ payment modes including UPI, Credit Cards, Debit Cards, Wallets, EMI, and BNPL

-

Payment Summary for Accuracy

Customers can review and confirm payment details before completing the transaction

-

Real-Time Payment Updates

Payments are confirmed in real-time, preventing service disruptions, & automatically updated in the provider’s system

-

Seamless ERP Integration

Direct integration with ERP systems for bill fetching and real-time updates on payment status

How to Use Easebuzz Bill Payment System

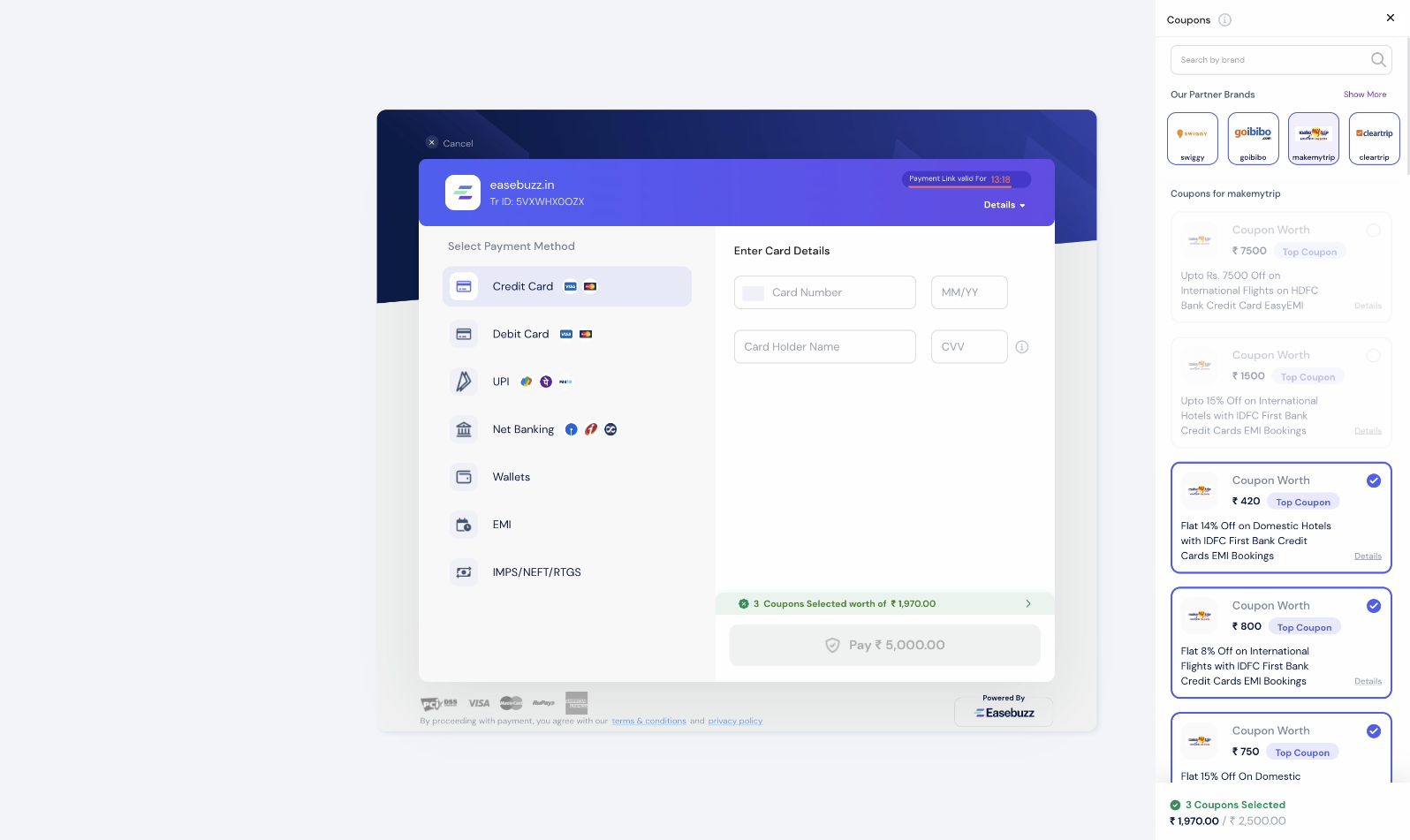

Easebuzz Bill Payment System supports 150+ payment methods

Accept payments from your customers through credit cards and debit cards on Easebuzz payment gateway.

Easebuzz payment gateway offers UPI option on checkout page to collect payments via UPI apps that enables your business to accept payments.

Start accepting payments through Netbanking option of 50+ banks including SBI, ICICI, HDFC, Axis, Kotak and Yes Bank on your checkout page.

Using Easebuzz payment gateway, you can easily accept payments through various mobile wallets of your customers.

Make your products affordable and accessible through easy EMI plans on Easebuzz payment gateway.

Let your customers Buy Now and Pay Later through the BNPL option on Easebuzz payment gateway.

Offer discount coupons & cashbacks on checkout page

Brand coupons Get the power of coupons for your business through Easebuzz payment gateway. Enable third-party coupons to reward your customers and increase stickiness.

Discount coupons With discount coupons get the accessibility to create and customise coupon codes, manage validity, payment mode-wise and bank wise applicability etc.

Manage end-to-end payment collections with complementing Easebuzz products

Teller

A Fast, Easy & Automated B2B Invoice management Solution

EasyCollect

API based solution to manage recurring & subscription based payments

SmartBilling

Invoicing solution with eNACH and subscription plans

Why choose Easebuzz payment links?

-

Quick onboarding

-

PCI DSS compliance level-1

-

Create instant payment links

-

24*7 technical support

Frequently Asked Questions

A secure and compliant solution for accepting bill payments. It integrates directly with service providers' ERP systems to offer static QR codes and payment links with multiple payment modes and notify real-time updates on payment status.

EBPS system adheres to all relevant regulatory standards, including RBI regulations, ensuring all transactions are conducted within a legally compliant framework.

Easebuzz supports over 150+ payment options, including UPI, credit and debit cards, wallets, EMI, and BNPL.

Through secure third-party integration, Easebuzz uses a smart form to verify unique customer credentials like bill numbers, flat numbers, and customer IDs. Ensuring accurate verification before processing payments.

Yes, the Easebuzz Bill Payment System seamlessly integrates with ERP systems via APIs to fetch bill details from ERP and provide real-time updates on payment statuses.

EBPS partially masks customer's sensitive information, such as mobile numbers, to enhance security and maintain confidentiality.

EBPS has an automated retry mechanism in the event of a failed transaction. If retries are unsuccessful, admins are notified for manual intervention to ensure the payment is completed.

Customers and service providers receive instant notifications of successful payments through SMS, email, or automated API updates.

Yes, Easebuzz provides a payment summary that allows customers to review and confirm all payment details for accuracy before finalising the transaction.

Payments are confirmed in real-time and automatically updated in the provider’s system, preventing any service disruptions.