Trusted by India's leading brands for payouts

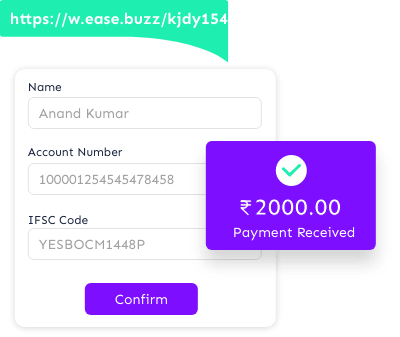

Wire Payout features for your business

-

Instant beneficiary addition

Now no need to wait for beneficiary activation with banks. Add and activate beneficiary accounts instantly. Use our Bulk Upload feature to add all your beneficiary accounts at once.

-

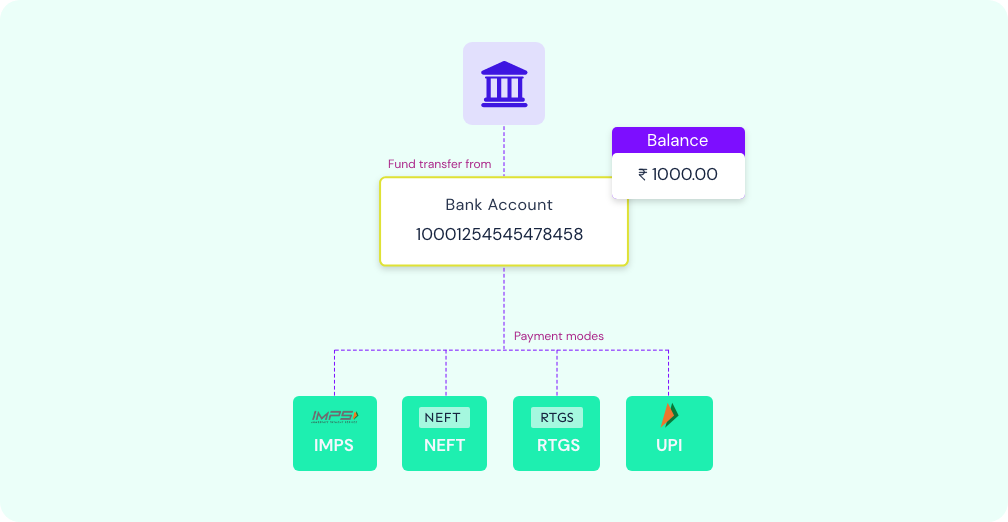

Multiple Payment modes

Wire enables you to make transfers/send money to your beneficiaries using UPI, IMPS, NEFT or RTGS.

-

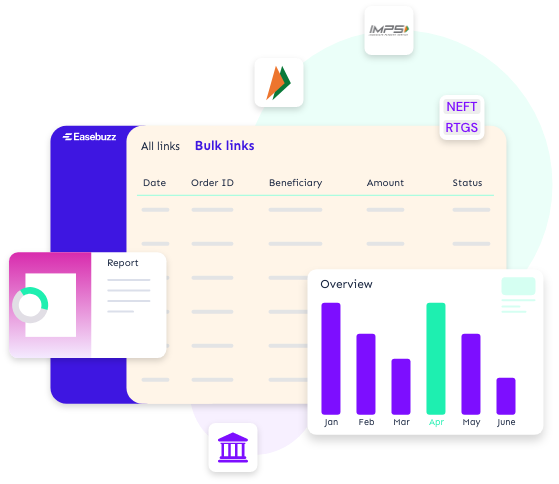

Multiple payouts at once

No need to process hundreds of transactions manually one by one. Just upload a single sheet and we will take care of processing all your transactions and give you a detailed report of your processed transactions.

-

Reconciliation & Reporting

Your bank account comes with a complete account statement that will help you keep track of all the credits & debits corresponding to all beneficiary transfers. On-demand reports will help you get all the data you need for different departments. E.g Accounts, Management, etc.

-

Maker-Checker Flow

You can create rules based on amount and transactions will go through only if it gets all the approvals from the required members.

Understand bulk payouts flow

How connected banking simplifies financial operations

With a connected banking set-up, a business can open a current account with a scheduled commercial bank and start using our payout services.

-

You can use your existing current account or easebuzz will help you create a fully digital current account with our partner bank.

-

You will have all control of your funds parked within our own bank's current account.

-

Payment Gateway settlements and Wire payouts could happen from the same account which would help in better cash flow & reconciliation.

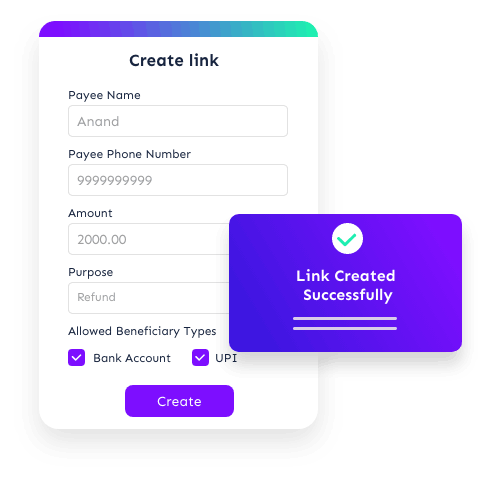

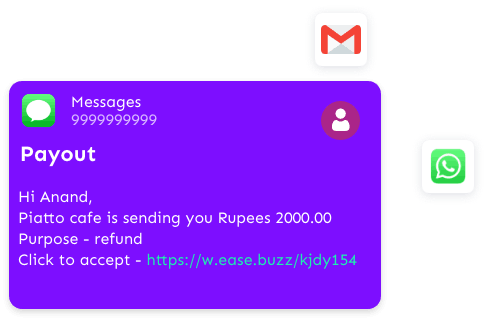

Vendor Payouts Link to transfer money online

With Payout Link feature, you don't need to know your customer’s account details in order to transfer money to them. Just create a payout link and send it to your customer via email, sms or whatsapp.

-

Payout links are secured with OTP authentication

-

Create payout links via dashboard or API

-

Notify users via whatsapp for better reachability

-

Payout links can have expiry date as per your need

-

Multiple payment modes allowed

How Easebuzz Wire Transfer Payout Links Works?

Create bulk payout links from dashboard or via API

Upon creation, customers will receive email, sms & whatsapp with a payout link.

Customers will open this link, enter account details and get money directly into their provider account details.

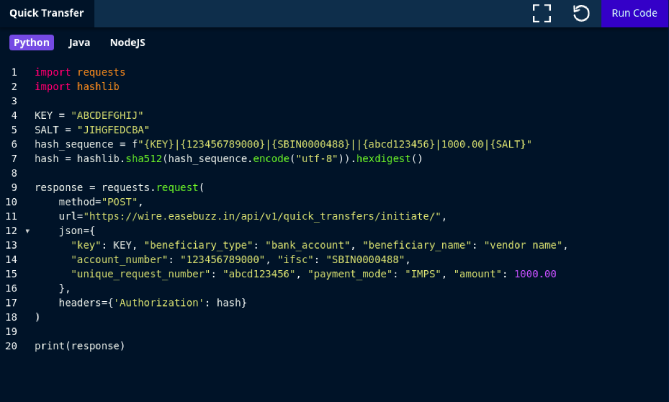

Easebuzz Wire Payout api provider : Payment Link Integration

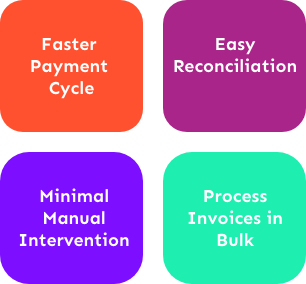

We have introduced Tally to ease the accounting system. Its Free!

With Tally Integration you can import tally invoices directly to your wire account and make payments to your vendors. Once the payment is done, wire will automatically sync paid invoice status to tally.

Tally Work Flow - Wire Payout

Watch our Product Video to see Easebuzz in Action

Bursting with the answers to your curious questions

Get In Touch

Developers Friendly

-

Wire comes with easy to integrate powerful APIs that your developers will have fun integrating. Each of the wire features are accessible over API.

-

Easy to understand & integrate.

-

Highly secure with our authentication mechanism & IP whitelisting functionality.

-

Faster response time.

-

Webhook functionality will help you get real-time updates on transaction status updates.

Frequently Asked Questions

If you are looking for a solution that would be your bulk payment system guide, Wire- is the right choice. It is fast, simple, and secure bulk payouts - go for Wire. Uploading a bulk transfer with Wire is very easy and can happen by uploading an Excel or even manually adding a beneficiary before you transfer. We automate and authenticate bulk transfers via APIs and make it much simpler as an alternative to uploading files on a bank portal.

Unlike banks, a single error can block all your payouts, Easebuzz ensures that valid transfers will go through even if there are error records in your file. Reconciliation with analytics is available on your dashboard and you can do transfer instantly without any risk.

Yes it is mandatory that your business is registered and only current account holders are allowed to use the application.

Transfers can happen immediately depending on your business requirement. Transfers in excess of Rs 2 Lakhs may take longer as they might be restricted by the banks.

Yes, you can send money to any active savings or current bank account in India. However, NRE and NRO bank accounts are not supported.

Wire is a SaaS-based API used by businesses to make bulk payouts and helps in disbursing payments instantly via NEFT, RTGS, IMPS, and UPI handles.

Sign up with Easebuzz and integrate Easebuzz Wire within your ERP System. Start creating payout links via dashboard or API. The payout links are secured with OTP authentication and have an expiry date as per your business need.

The vendor payment process includes verifying invoices, approving payments, and making payments through checks or electronic transfers. Automation simplifies this process by digitalizing invoices to reduce errors, automating approval workflows, and integrating with accounting systems for accurate records. It also provides real-time visibility into payment statuses, helping avoid delays and maintaining strong supplier relationships.

Scale-up your Business

with Easebuzz Payment Solutions Platform

Documentation

Documentation