Easebuzz payments platform is trusted by India's leading brands

Interoperable platform connecting suppliers and buyers for seamless transactions

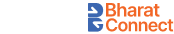

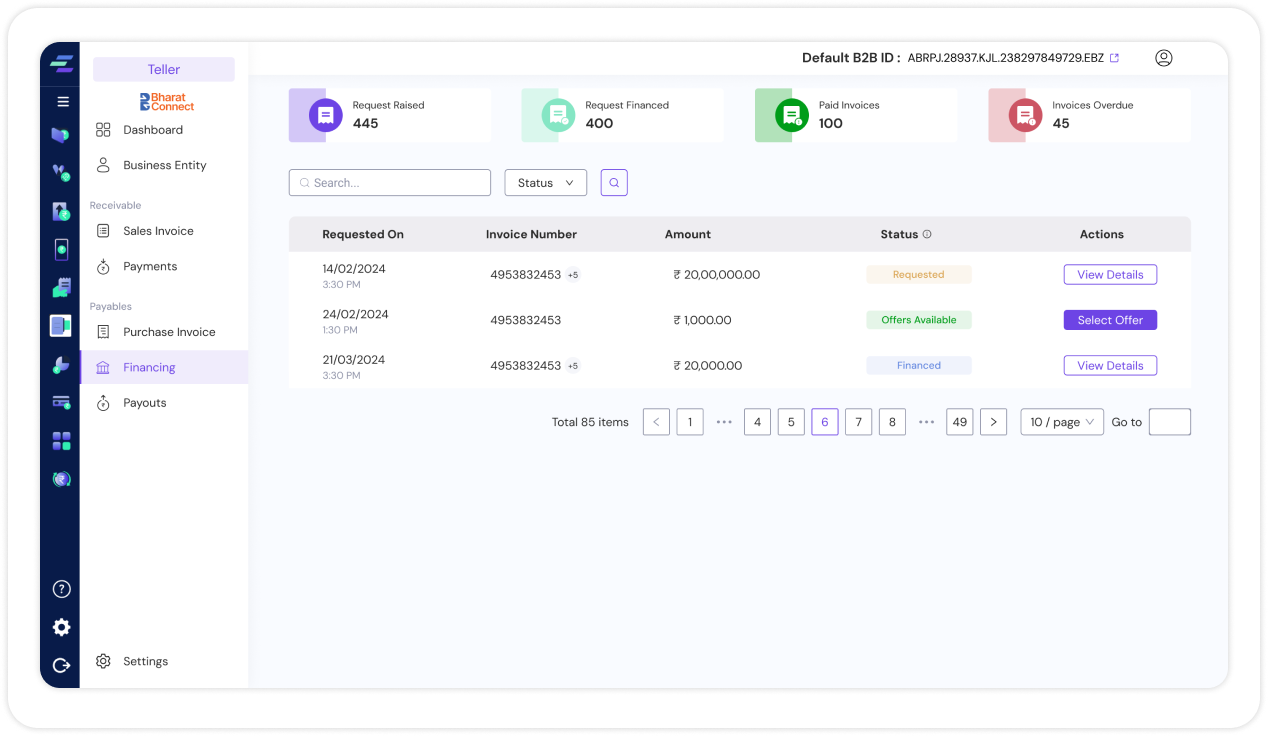

Easebuzz Teller empowers suppliers and buyers to manage invoices and payments seamlessly in one place. Designed for industries like manufacturing, distribution, retail, FMCG, textiles, pharmaceuticals and more, it streamlines invoicing, payment collections, and cash flow management. With real-time data visibility, fetch business entities data, GST invoicing, and finance on invoice through TReDS.

Oversee various sub-entities like GSTINs, regional offices, and business units with ease, and track metrics at an individual level for precise business management.

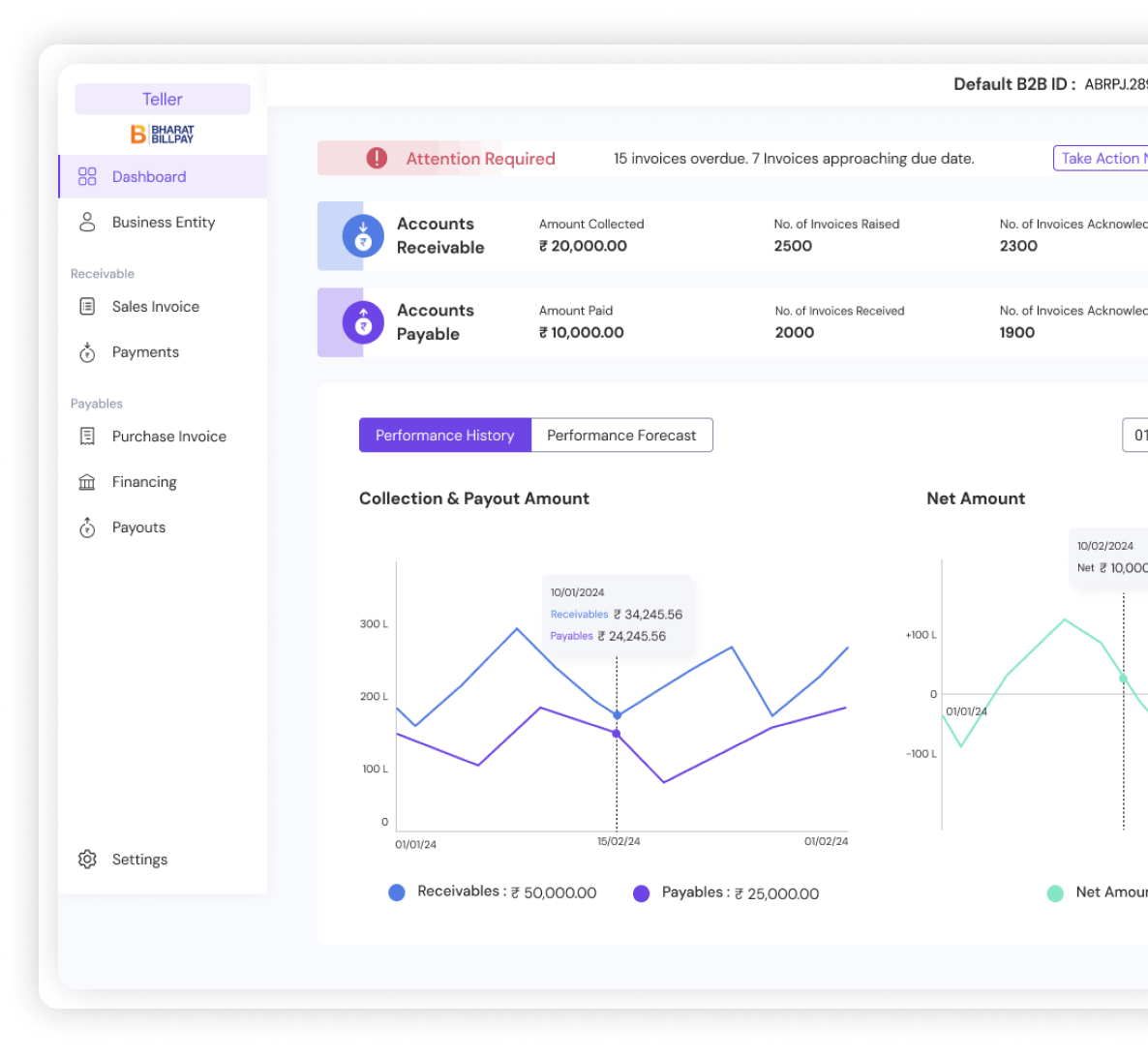

Create invoices, send automated reminders, and manage workflows with real-time updates. Link POs to invoices for comprehensive tracking of receivables.

Automatically fetch purchase invoices with options for partial or full payments through the BBPS platform. Record offline payments and obtain acknowledgements from suppliers.

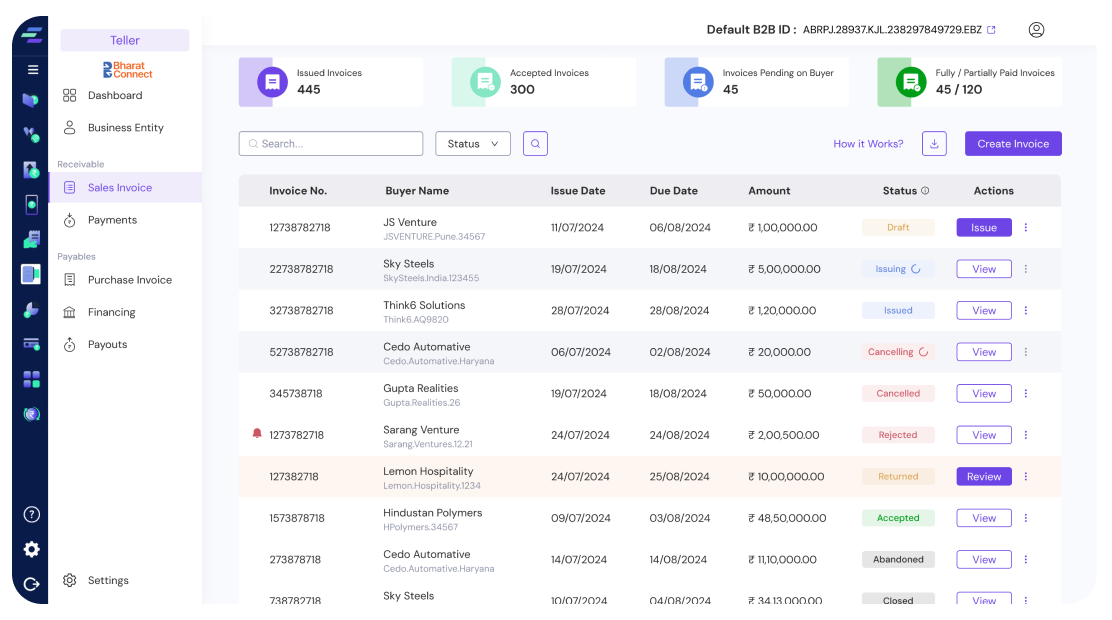

Make and receive payments seamlessly via the Easebuzz platform through the Bharat BillPay network, ensuring a smooth transaction experience.

Flexible Financial Credit Flow

Access invoice discounting offers from various financiers via the TReDS platform based on cash flow, and effectively manage working capital.

Online payment gateway with 150+ payment methods

Pay bills using cards, UPI, Net Banking, offering flexibility in payment methods.

Accept payments from your customers through credit cards and debit cards on Easebuzz payment gateway.

Easebuzz payment gateway offers UPI option on checkout page to collect payments via UPI apps that enables your business to accept payments.

Start accepting payments through Netbanking option of 50+ banks including SBI, ICICI, HDFC, Axis, Kotak and Yes Bank on your checkout page.

Using Easebuzz payment gateway, you can easily accept payments through various mobile wallets of your customers.

Collect payments in your current bank account and track transfer status in real time

Give option for your customers to make an offline Bank transfer via NEFT, RTGS and IMPS and reconcile centrally.

How does Easebuzz B2B payments work?

Easebuzz partners with NBBL and launched B2B Payments Platform

NPCI Bharat BillPay is now Bharat Connect

Manage end-to-end payment collections with complementing Easebuzz products

SmartBilling

Invoicing solution with E-Nach and subscription plans

Wire

Disburse payments via NEFT, RTGS, IMPS and UPI Handle

Payment Gateway

Accept payments with an API integration

Frequently Asked Questions

Easebuzz Teller is a centralised B2B payment platform that streamlines invoicing, payment collections, and business operations with interoperable system connected to NPIC Bhart Connect rails.

Easebuzz Teller platform optimises business operations by centralising invoicing, payment collections, and communication.

Easebuzz Teller is designed for businesses across industries into B2B space such as manufacturing, distribution, retail, FMCG, textiles, pharmaceuticals, and more.

You can start in seconds by creating your B2B ID using your PAN and GST number on Easebuzz Teller platform and enable quick vendor registration with NPCI Bharat Connect Ltd. for cross-platform visibility and seamless payments.

The platform enables effortless vendor registration by entering GST or PAN details, which automatically retrieves vendor information. It also allows for quick access to past vendor data and validates bank accounts through penny-drop tests to ensure accuracy.

Easebuzz Teller uses standardised protocols for invoicing, payment, communication, and reconciliation. It also allows for real-time invoice sharing, automated retrieval, and management, ensuring smooth end-to-end processes.

Easebuzz Teller supports multiple payment options, including Debit Cards, Credit Cards, Net Banking, and UPI.

Yes, Avail invoice financing using TReDS platform. Easebuzz merchants can share invoices directly on the platform for financing, compare offers from multiple lenders, and access secure funding for buyer-approved invoices.

Yes, you can set up approval workflows for vendors and payments to prevent unauthorized transactions. The platform also supports amount-based approvals and provides transparent tracking of approvals for audit purposes.

Easebuzz Teller offers real-time data visibility, tracking of payment and approval trails, and secure digital data, providing enhanced trust and transparency for businesses.