Trusted payment gateway in India for leading brands

Easily accept online payments on your website or app

Easebuzz payment gateway provides a secure and reliable method of accepting online payments for your business. It comes with best-in-class features like automated reconciliation, refund management, brand and discount coupons for your customers, etc.

-

150+ payment options

Accept payments through credit cards, debit cards, UPI, wallets, EMI & BNPL with Easebuzz payment gateway

-

Best payment success rate

Higher payment success rates for enhanced customer experience and improved business revenues

-

Easy integration

Developer friendly APIs and plugins to ease the integration process supported by detailed API documentation

-

iFrame checkout

Embed the hosted checkout page on your website or app easily and offer seamless checkouts for your customers

-

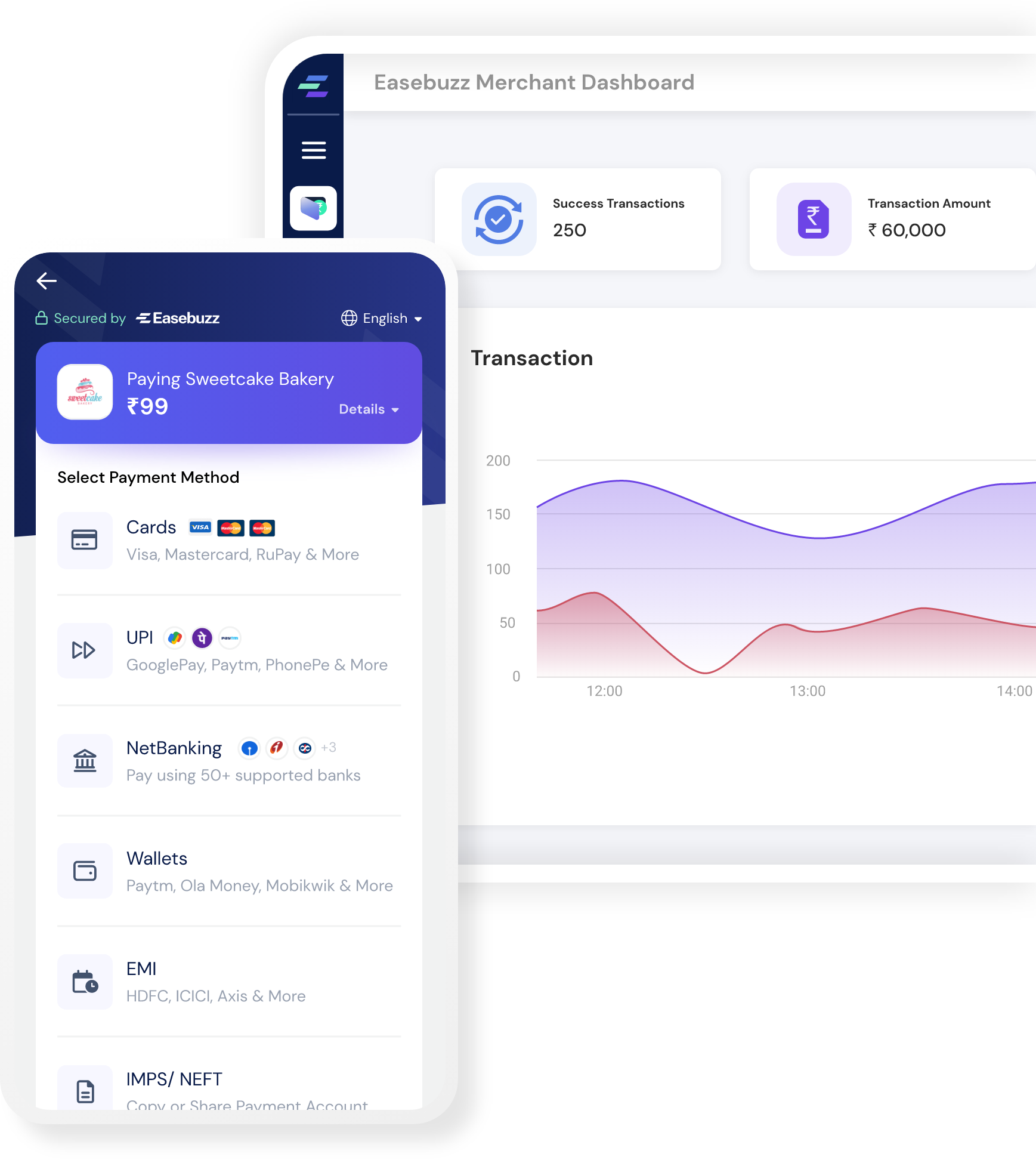

Unified dashboard

Dashboard with real-time transaction data, customisable reports, and detailed payment insights

-

Dedicated technical support

24*7 technical support to help you with your integrations and any queries

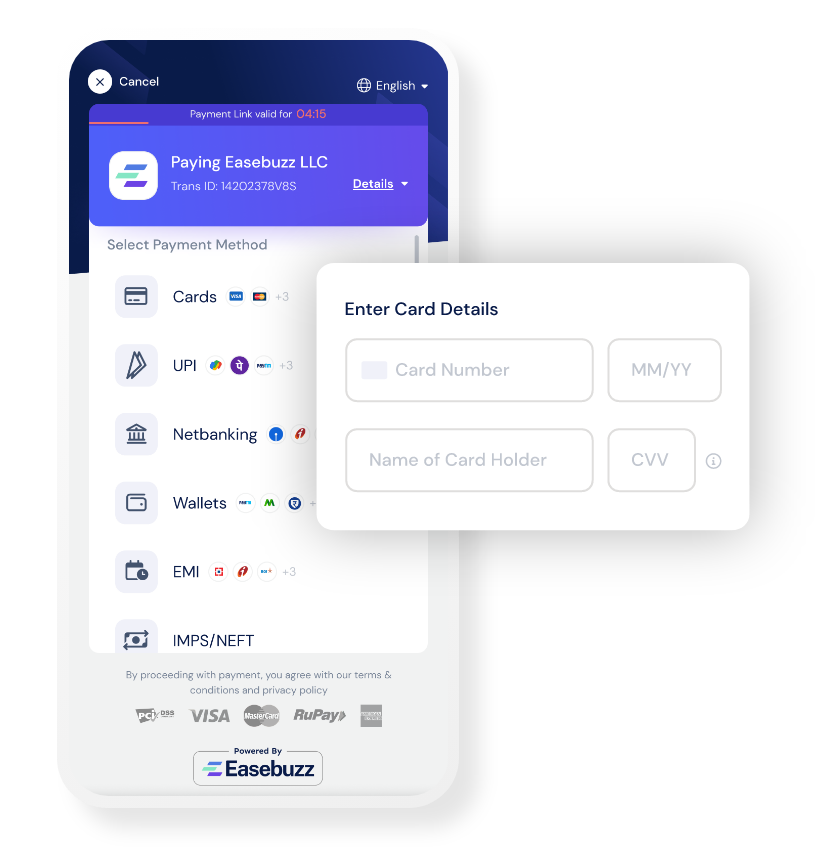

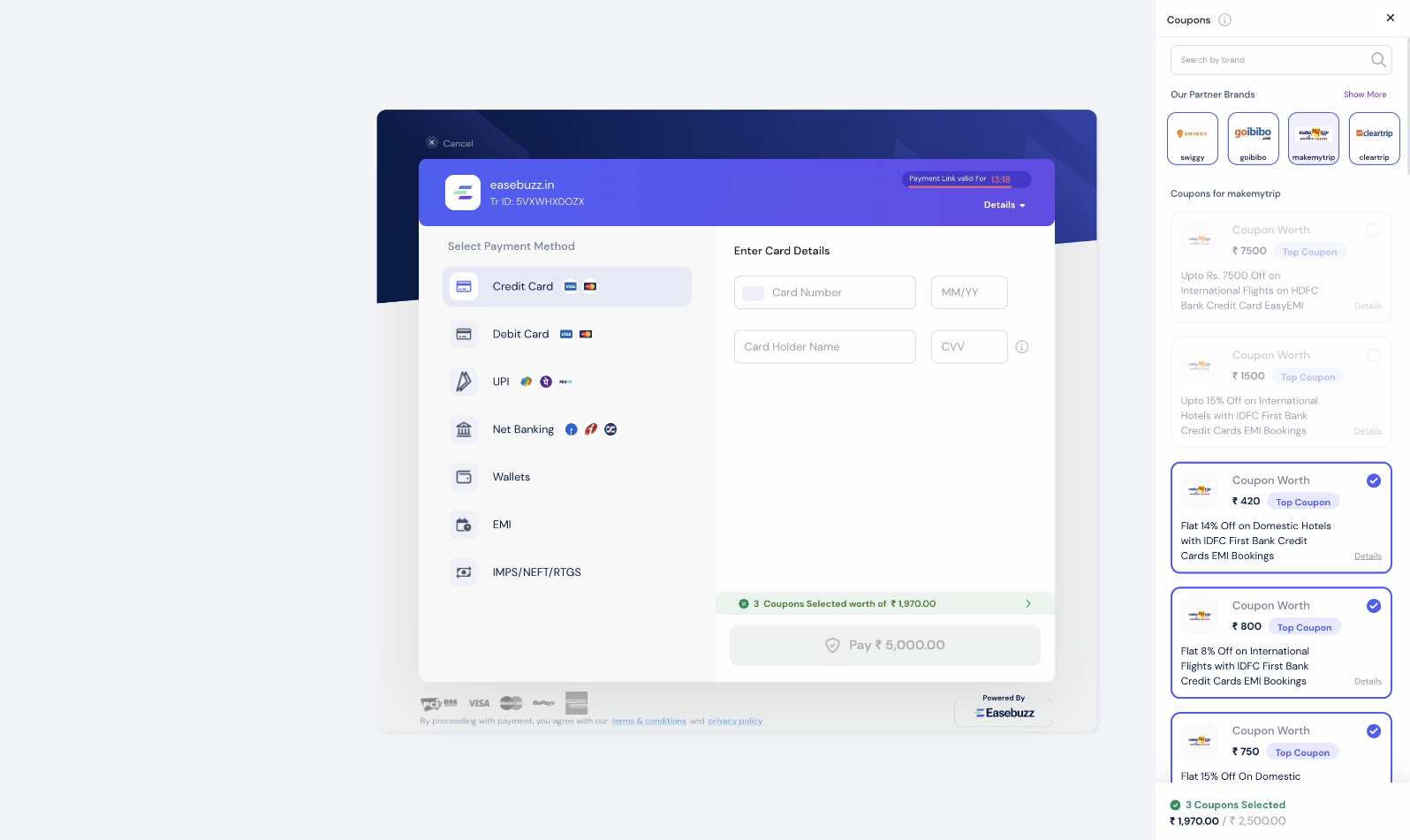

Seamless checkouts with Easebuzz online payment gateway

Embed iFrame checkout page with customised branding, multilingual support and 150+ payment modes including credit card, debit card, 50+ netbanking options, UPI, and wallets to easily accept online payments from your customers.

Online payment gateway with 150+ payment methods

Accept payments from your customers through credit cards and debit cards on Easebuzz payment gateway.

Easebuzz payment gateway offers UPI option on checkout page to collect payments via UPI apps that enables your business to accept payments.

Start accepting payments through Netbanking option of 50+ banks including SBI, ICICI, HDFC, Axis, Kotak and Yes Bank on your checkout page.

Using Easebuzz payment gateway, you can easily accept payments through various mobile wallets of your customers.

Make your products affordable and accessible through easy EMI Plans on Easebuzz payment gateway.

Let your customers Buy Now and Pay Later through the BNPL option on Easebuzz payment gateway.

Give option for your customers to make an offline Bank transfer via NEFT, RTGS and IMPS and reconcile centrally.

Enable standing instructions for auto debit of recurring payments through eNACH or UPI 2.0 mandate for your customers.

Easily manage discount coupons & cashback offers

Brand coupons Get the power of coupons for your business through Easebuzz payment gateway. Enable third-party coupons to reward your customers and increase stickiness of your website.

Discount coupon engine With discount coupons get the accessibility to create and customise coupon codes, manage validity, payment mode-wise and bank wise applicability etc.

Benefits of using Easebuzz online payment gateway for your business

-

Quick and easy checkout process

-

Better customer experience

-

Reduces cart abandonment

-

Industry best success rates

-

Gather valuable insights

-

Instant settlements

-

Instant Refunds

-

Better fraud management

Safe payments with best security & compliance

PCI DSS compliant

Easebuzz payment gateway offers secure payment processing methods and is PCI DSS Level- 1 compliant.

Card tokenization

Card tokenization will encrypt and replace sensitive data such as 16-digit card numbers, names, expiry dates, and security codes with a ‘token’.

Encryption and data masking

We keep a close track of the security events, vulnerabilities, anomolities to put in place respective preventive strategies by patching all infrastructure vulnerabilities and getting rid of obsolete encryption standards like TLS 1.0 and TLS 1.1

Online payment gateway integrations made simple & easy

Easebuzz payment gateway comes with simple SDKs and APIs along with detailed API documentation

We are developer centric

Digitise your online payments and financial operations by easily integrating plug-and-play, developer-friendly APIs into your own tech stack, website, apps, ERPs and CRMs. Sign up and get started in minutes with Easebuzz payment solution platform.

What our customers say about us

Our experience with Easebuzz payment gateway has been excellent and it helped us with 4 times improvement in our payment success rates. Earlier, we used to face payment reconciliation issues, which have been resolved with Easebuzz platform’s auto reconciliation feature.

Tanya Saigal

Customer Experience

M2M Ferries

We are very happy with Easebuzz services and find it easy-to-use not only from a business perspective but also from a developer's point of view. We look forward to taking this partnership further.

Abhishek Kumar

Founder, Director

docOPD

The best part about the Easebuzz API solution is their smooth onboarding process that automates the procedure including underwriting, making it effortless. Products from the Easebuzz payment solution suite including Slices and FeesBuzz have helped us in collecting payments with no fuss.

Anupam Jeevan

Director

Dexpert Solutions

Manage end-to-end payment collections with complementing Easebuzz products

Slices

Automatically split incoming payments to multiple accounts & settle funds to vendors

EasyCollect

API based solution to manage recurring & subscription based payments

InstaCollect

Collect payments instantly through virtual account.

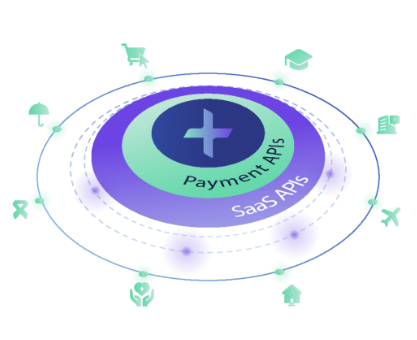

Digitise not just payments but end-to-end financial operations with tech-enabled SaaS solutions, tailor made for each sector

-

FeesBuzz

-

Forms

-

EasyCollect

-

Teller

-

InstaCollect

-

SmartBilling

-

Webstore

Why choose Easebuzz payment gateway solution?

-

Plug and play APIs

-

PCI DSS compliance level-1

-

Quick onboarding

-

24*7 technical support

Frequently Asked Questions

A payment gateway is an API used by businesses to accept payments online through different payment modes like credit cards, debit cards, UPI, ewallets, netbanking, etc. Businesses integrate payment gateways on their website or app to make sure their customers experience hassle-free payment transactions. The technology platform is PCI DSS complaint, making it highly secure, reliable and safe for digital transactions.

Easebuzz offers customisable pricing structure basis your business needs. Please connect with your relationship manager for more details.

Once the payment gateway integration is done in your system, it will start accepting card payments within a day. Payment gateway allows your customers to pay by credit card, debit card, 50+ net banking options, wallets like OLA Money, UPI and EMI.

The Payment Card Industry (PCI) applies to companies of any size that accept credit card payments. It refers to the technical and operational standards that businesses follow to secure and protect credit card data provided by cardholders and transmitted through card processing transactions. When your payment gateway is PCI DSS complaint, the transactions made on the platform is safe and secure.

Yes, you can accept payments via Netbanking. Easebuzz payment gateway allows you to accept payments online with 50+ Netbanking options like HDFC Bank, ICICI Bank, AXIS Bank, YES Bank, State Bank of India etc.

In the process of integrating payment gateway in your system, KYC document is required as the details are captured via Easebuzz payments bank’s authorized application and are transmitted securely to our servers. These data are not stored in any representative’s handset. Our process follows strict regulatory guidelines laid down for banks and are frequently subjected to external audits.

If you already have a website you can directly integrate Easebuzz payment gateway. If not, collect payments without website using Payment Links from Easebuzz merchant dashboard and easily share the links with customers via Email / SMS / WhatsApp and start accepting payments online.

We work on the lowest margins and our pricing is the most competitive in the market. However, if you drive good volumes then you can also get customized pricing based on your needs. Goto contact us page and contact the sales team to know more. Easebuzz Payment gateway offers plans designed for startups, SMEs, large enterprises, etc.

Yes, Easebuzz platform can be used as UPI payment gateway platform.

Unified Payments Interface (UPI) isn’t a payment gateway. It can be best described as a real-time payment system that allows users to make instant payments and transfer funds between bank accounts via their mobiles.

Yes, payment gateways are typically safe since they follow stringent compliance and security standards including PCI-DSS to safeguard sensitive financial information when transactions are made. Additionally, payment gateways also use tokenisation and encryption to ensure data security and prevent fraud.

While UPI is free for users, gateway vendors charge a fee for processing transactions if it is integrated into a payment gateway system.

A payment gateway API is a software interface or tool that enables developers and other end-users to integrate a payment processing feature into websites and applications. In short, it facilitates seamless communication between a payment gateway and a merchant’s platform.

Every business or individual who wants to accept online payments including e-commerce businesses, small businesses,and subscription-based services to name a few requires a payment gateway.

Typically, the payment gateway provider is likely to deactivate your account if it is inactive for a long time. You can reactivate your account by reapplying or signing up again.

Yes, Easebuzz provides 24/7 customer support to address technical issues, answer customer queries, and troubleshoot. Users can reach Easebuzz’s support team via phone or email.

A payment gateway works by encrypting the transaction details of a customer and sending information to the payment processor. It then communicates with banks to accept or decline transactions and sends the response received to the merchant and users.

You can integrate a payment gateway into a website by picking a reliable payment provider and understanding how their APIs work and can be integrated into your website. Then, you need to install the plugins, SDKs, or APIs into your website and test it before going live.

You can pick the payment gateway by taking into several factors including ease of integration, available customer support, payment success rate, security and transaction fees, and platform pricing.

Yes, Easebuzz is RBI approved. It has received final authorization from the Reserve Bank of India (RBI) to operate as an Online Payment Aggregator under the Payment and Settlement System Act, 2007. It enables Easebuzz to provide regulated and secure digital payment solutions (PG) for businesses across various sectors in India.