Trusted by India’s leading brands

Pay all your Taxes Online with single-click setup on Easebuzz Neo

Easebuzz Neo accounts allow you to pay your GST and Direct Tax payments with a single-click.

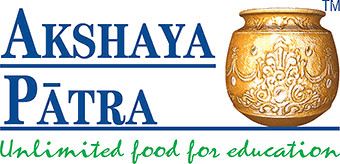

Seamless Online Tax payments Just in 3 steps

Automate your business tax payments with current account linked to Easebuzz Neo

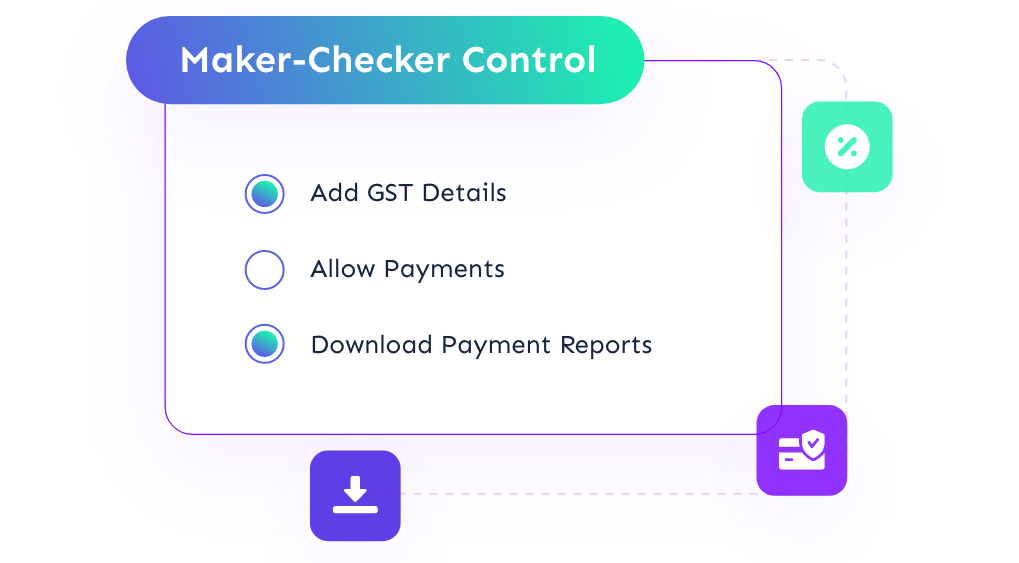

Monitoring & Download your Tax Payments Reports Without Much Hassle

Enable maker-checker approval flow for every payment request before deduction of funds.

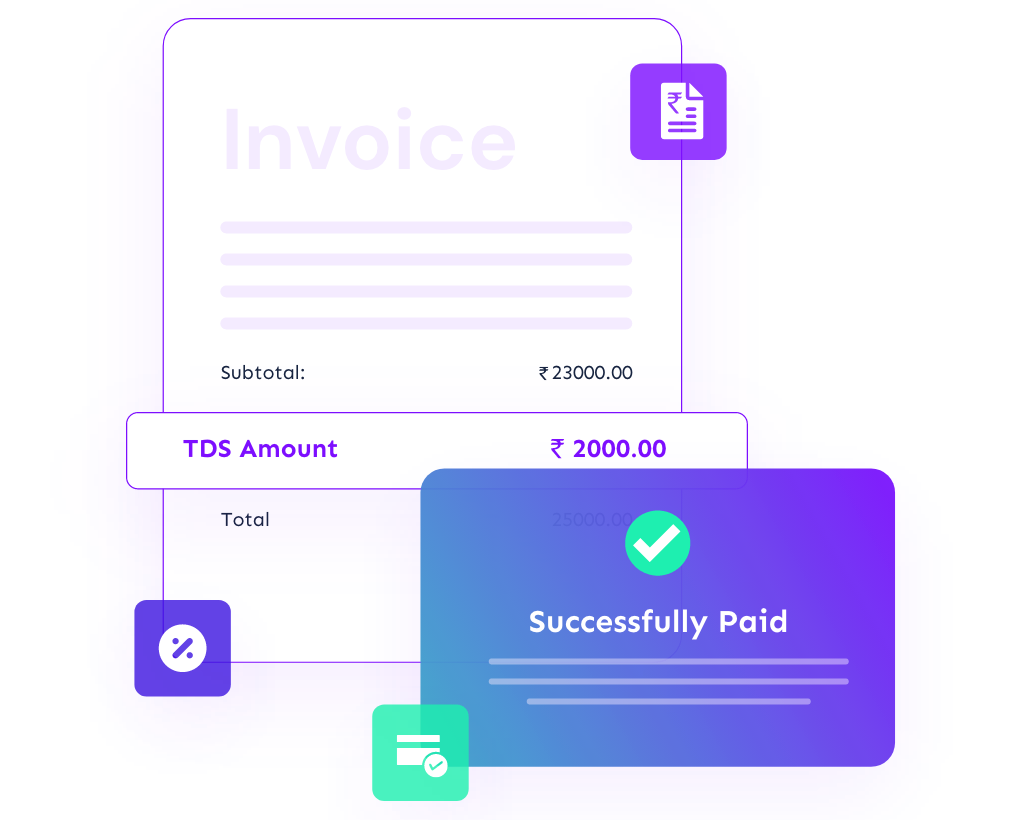

Automate your TDS deduction with Easebuzz Neo

Automate TDS deduction and payments for issued invoices and balance payments.

Generate Tax Challans with one single click

Access all your Tax challans in one single place to initiate payments.

Schedule & Pay your Taxes on time

Schedule automated reminders and notifications to avoid late payments.

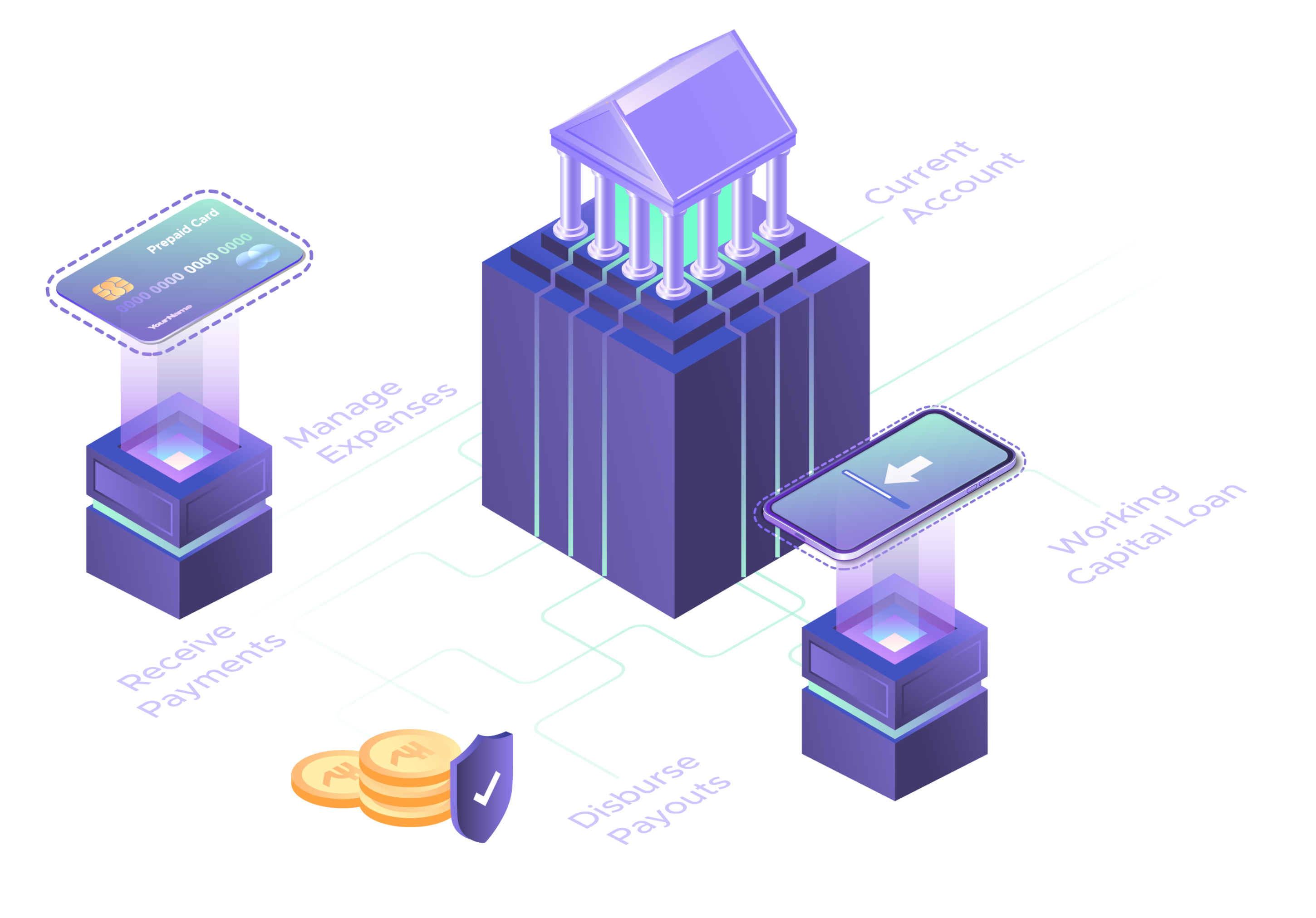

Feature-packed Connected Banking to Automate your Financial Operations

Get Integrated & Comprehensive Current Account for managing Banking, Payments and Expenses - All at one place

Sign Up Now!

Frequently Asked Questions

Easebuzz product called Online Tax Payments allows merchants to seamlessly pay Taxes across multiple categories in one place.

Need to generate challans on GST portal and fetch the challan details in the Easebuzz portal then select source account & make GST payment.

With one single-click you can fetch your TDS challans, add your GSTIN details and click on fetch challans the system will fetch all your challans which are paid and pending for your e challan payments.

You can pay through Easebuzz Neo virtual account and Credit Card.

To make your e-payment tax done, start by going to Online Tax Payments on your Easebuzz dashboard and entering the details like TDS category, major head, minor head and tax amount to complete the payment and receive the challan.