Trusted by India’s leading brands

Complete finance management for your business

Get full control on your business expenses

-

Reimbursements are easy with real-time tracking, monitoring, and reporting of expenses

-

Optimize your expenses by allocating Prepaid cards to different Expense Categories

-

Automatic recurring payments are available via both physical and virtual prepaid cards, so you will never miss a payment deadline

-

Create spending limits on business prepaid card

-

Easy ledger management , automatic reconciliation, and automatic categorization of spendings

-

Real-time visibility of every transaction allows you to avoid duplicate payments and fraudulent activity

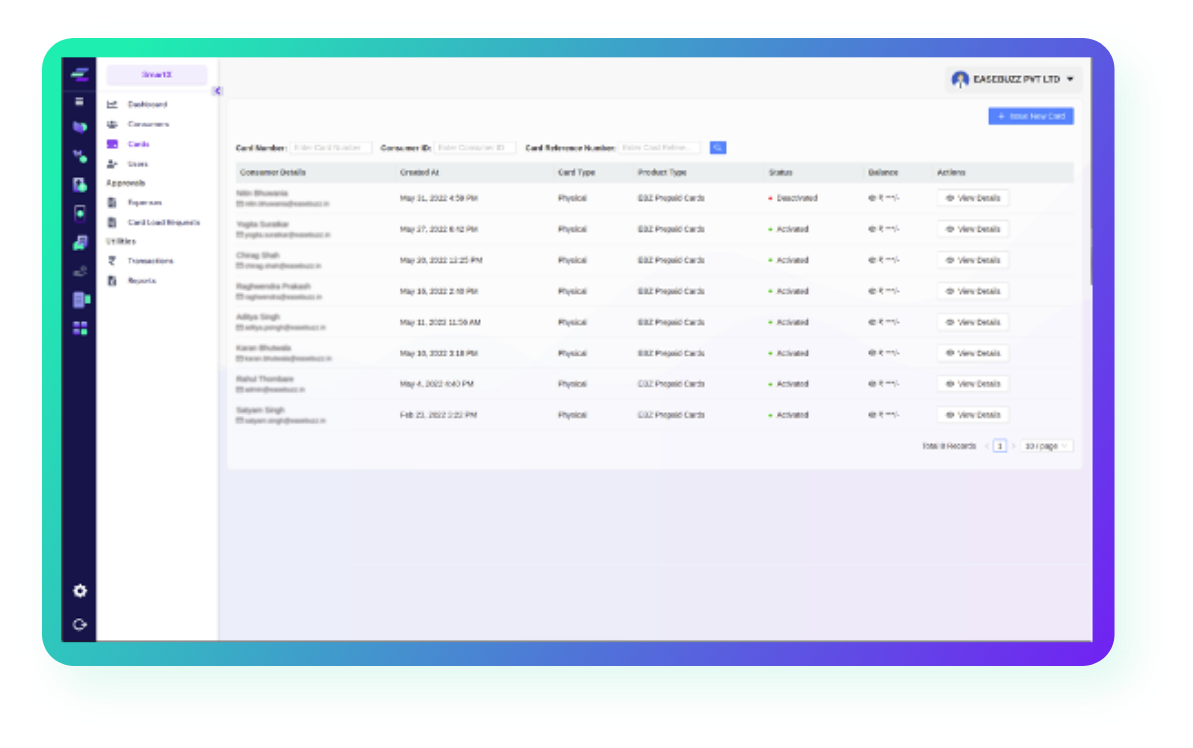

Powering businesses with smart expense management

-

Dashboard gives quick access to a variety of information for the organization.

-

Corporate Balance: This provides the current available balance in the organization/corporate account which can be used to load the prepaid cards.

-

Cards issued: The number of cards that have been issued to consumers (Employees) including Prepaid Card and Gift Cards.

-

Total Consumers: This shows the total number of consumers created in the system.

-

Total transactions received from all prepaid cards or Gift cards the organisation issued to consumers.

-

Define multi-level approvals and rejections for expense requests.

Easebuzz SmartX Cards

Prepaid cards for expenses on-the-go

Powered by

Reduce manual interventions to save on time and money

-

Control on customer / employee spending

-

Saving time and efforts by reducing the manual intervention for reimbursement process

-

Prepaid cards are always EMV chip and PIN compliant

-

Assuring the transparency by reducing the cash involvement of the consumer

-

Track employee expenses and automated reports for the organisation

-

Reducing scope of loss and fraud as no bank account is linked to the prepaid card

Simplifying reimbursements with Easebuzz prepaid cards

-

Consumer dashboard gives quick access to employees about their prepaid spends information

-

View reimbursements approval or rejection status

-

Upload expense receipts with ease

-

Raise load request for amount to reload in the prepaid card

-

Track spending reports

-

Block or unblock cards

-

Set security PIN for prepaid card

-

Get notifications & alerts

Digitize your Business Expenses

with SmartX Expense Management

Frequently Asked Questions

Every business has multiple consumers with different official expenses. For a business owner or any organisation, it is difficult to identify, track and control those expenses. SmartX gives you a Hassle-free way of managing finance expenses with spending reconciliation records in a single dashboard through prepaid cards, and reimbursements management.

Once a consumer has been created in the system, Admin will issue a KYC request to the consumer. After the KYC details have been submitted, Admin can issue a credit card to the consumer in Virtual or Physical Cards.

SmartX Dashboard allows the admin to manage a variety of cards via Card Load Request. You can load money and set a budget for controlling spending.

Consumers can submit reimbursement approval requests via the user dashboard. If required, they can upload receipts and submit them for approval to Admin. The status of the request can be viewed in Approved, Partially approved, Pending and Rejected.

Use prepaid cards to control consumer spending and stop non-compliant transactions. Limit spending to a certain amount per day, week, or month, or to a particular channel (Online, ATM, POS).

SmartX is the best expense management software used to manage official expenses for various consumers in any organizations.

Expense management system helps to simplify travel & expense operations of employees. Benefits of expense management system are: faster, simpler process, faster reimbursements, fewer delays, increased operational efficiency, improved visibility, simplified reporting, etc.

Expense management system for SMBs gives insight into employee expenses and categorize expenditure. It makes savings on business travel, expenses, and invoicing. ensures tax compliance, provides cost savings, etc.