Trusted payment gateway in India by leading brands

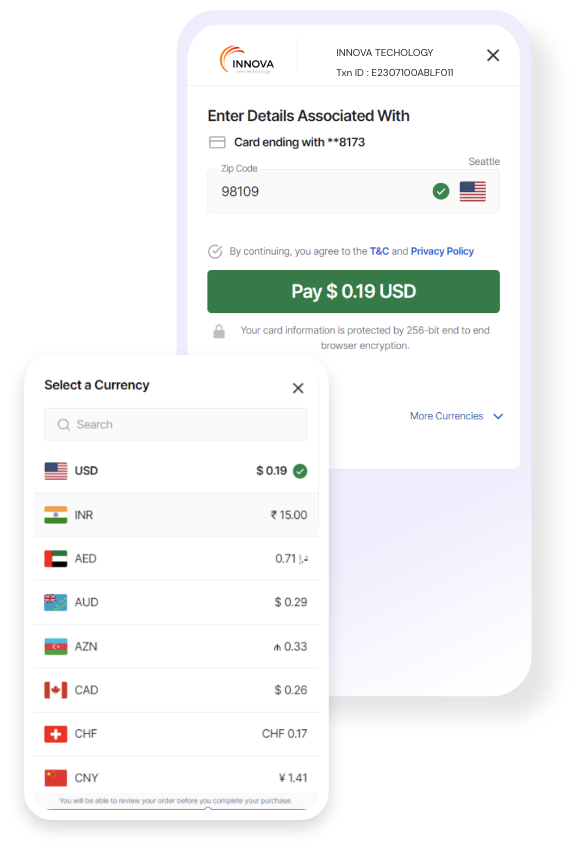

Accept International payments with Easebuzz International Payment Gateway

Easebuzz international payment gateway allows businesses in India to accept payments globally and provides a secure, reliable method of accepting online payments for your business. For cross-border payments, Easebuzz comes with best-in-class features like automated reconciliation, amount conversion rates & settlements, seamless integrations etc.

-

Collect payments from 30+ countries

Supports 30+ international currencies including GBP, HKD, ILS, JOD, JPY, KRW, etc.

-

Secure transactions

Robust security for online transactions with PCI DSS compliance.

-

Dynamic currency conversion

Automatic and real-time currency conversion at the time of payment.

-

Quick integrations

Simple and easy integration to accept cross border payments.

-

Settlement in INR

Timely disbursement of international transaction funds to your settlement account in INR currency.

-

FIRC Certificate

Receive Foreign Inward Remittance Certificate (FIRC) on your registered email ID.

How to accept payments with international payment gateway

-

Step 1: Sign-up with Easebuzz

-

Step 2: Integrate Easebuzz payment gateway

-

Step 3: Request for cross-border payments

-

Step 4: Collect payment in different currencies on Easebuzz

-

Step 5: Receive payments in INR

Cross border payments with best security & compliance

PCI DSS compliant

Easebuzz international payment gateway offers secure payment processing methods and is PCI DSS Level- 1 compliant.

3DSecure 2.0

Offers customers a faster and secure checkout experience while complying with global 3DS framework mandates.

Encryption and data masking

Keep a close track of the security events, vulnerabilities, anomalies to put in place respective preventive strategies by patching all infrastructure vulnerabilities and getting rid of obsolete encryption standards like TLS 1.0 and TLS 1.1

Business benefits of International payment gateway

-

Quick and easy checkout process

Easebuzz international payment gateway offers seamless and user-friendly checkout process.

-

Better customer experience

Globally accept payments and offer better customer experience with Easebuzz payment gateway.

-

Reduces cart abandonment

With smooth, frictionless checkout flow, and 150+ payment methods, lessen the card abandonment issue.

-

24*7 technical support

Technical support through multiple channels like email, toll-free phone calls, WhatsApp and chatbot help desk.

-

Receive transactions in Indian rupees

Amount settled into bank account will be in INR for all international currencies.

-

Better fraud management

Transactions are secured on PCI DSS infrastructure so the amount processed are safe and encrypted.

What our customers say about us

Easebuzz has been our go to partner for payment link solution. Before onboarding with Easebuzz we were accepting payments only through POS machine and NEFT method. With the help of Easebuzz payment links, our customers can now conveniently pay through multiple payment modes like netbanking, debit cards, credit cards, UPI, wallets etc. Payment reconciliation has also become easy and automatic. We highly recommend Easebuzz for every business.

Abdullah Shaikh

Founder

AK Motors

Easebuzz has helped us resolve our payment related issues with their payment solutions like Payment link, Payment Gateway. Payment collection has been easy and reconciliation process is now fully sutomated with Easebuzz services.

Pratiksha

Founder

Roohaniyat

Our experience with Easebuzz payment gateway has been excellent and it helped us with 4 times improvement in our payment success rates. Earlier, we used to face payment reconciliation issues, which have been resolved with Easebuzz platform’s auto reconciliation feature.

Tanya Saigal

Customer Experience

M2M Ferries

Get a full stack of payment solutions with payment gateway to help your business grow

Manage end-to-end payment collections with complementing Easebuzz products

Slices

Automatically split incoming payments to multiple accounts & settle funds to vendors

EasyCollect

API based solution to manage recurring & subscription based payments

InstaCollect

Collect payments instantly through virtual account.

Frequently Asked Questions

Best for International Transactions: Easebuzz offers a secure and reliable platform for businesses to accept payments globally.

Receiving Time: The timeframe for receiving international funds can vary depending on banks and regulations, but Easebuzz facilitates a smooth process.

Paying Internationally: You can't directly pay through Easebuzz, but businesses accepting Easebuzz can receive your international card payments.

Supported Currencies: Easebuzz supports over 30 international currencies, including USD, GBP, EUR, and more.

Card Charges: Yes, international card transactions typically incur processing fees.

Settlement: Easebuzz offers automatic currency conversion and settlements in INR to your account.

Payment Modes: Accept payments via cards, wallets, Netbanking, Wire, UPI, and other popular international methods.

Documents for Setup: Contact Easebuzz support for their latest KYC requirements for international transactions.