CATEGORY - PAYMENTS

Cancelled Cheque: Sample image and How to Write 'Cancelled' on It

Payments - 21 Mar, 2025

-

Table of Contents

What is a Cancelled Cheque?

A cancelled cheque is a standard bank cheque that has been marked, usually by drawing two parallel lines across it and writing “CANCELLED” in between. This makes the cheque invalid for any financial transaction but still retains important information like the account holder’s name, account number, bank name, and branch details.

Why is a Cancelled Cheque Required?

A cancelled cheque is commonly requested for:

-

KYC verification: For opening bank accounts, Demat accounts, or investment purposes.

-

Loan processing: To verify bank details for EMIs and disbursements.

-

ECS mandate: For automatic payments like SIPs or insurance premiums.

-

Salary account setup: Employers may require it to process salary credits.

Since a cancelled cheque cannot be used for withdrawals or payments, it ensures security while confirming banking details.

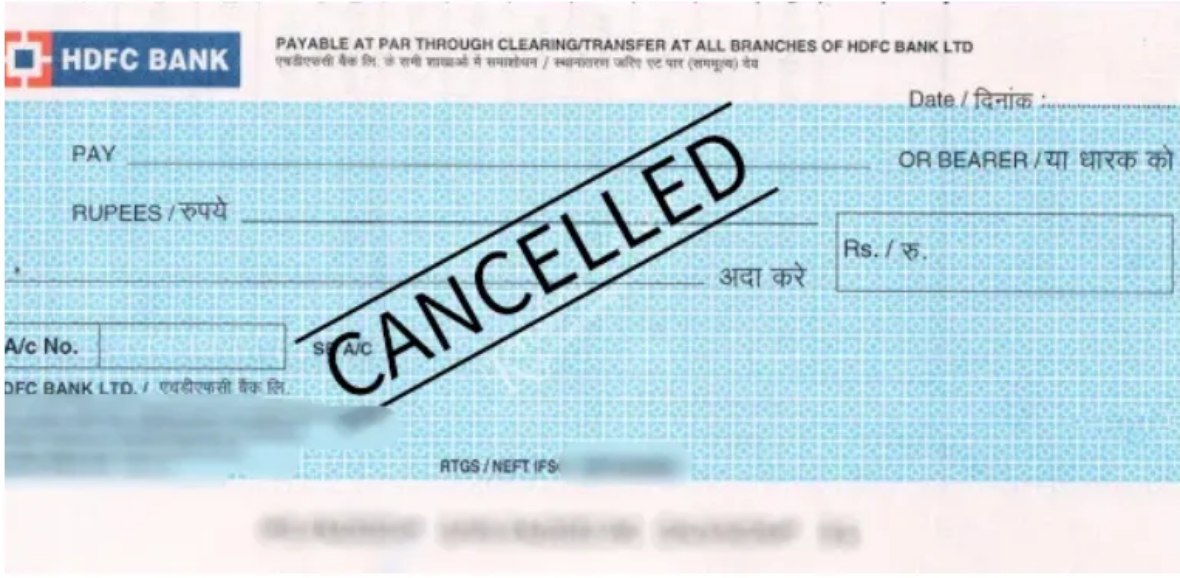

Cancelled Cheque Photo or image

A cancelled cheque is a leaf with two diagonal lines drawn across it and “CANCELLED” written between them. It is often required for KYC verification, setting up auto-debit mandates, or validating bank details. Below is a sample image of a cancelled cheque for reference.

Example: SBI Cancelled Cheque Image

Example: HDFC Cancelled Cheque Image

What Information Does a Cancelled Cheque Contain?

A cancelled cheque provides essential banking details without authorizing transactions. It includes:

-

Account Holder’s Details: Name (if pre-printed) and account number

-

Bank Information: IFSC code, branch details, and cheque number

-

Security Feature: MICR (Magnetic Ink Character Recognition) code

Importantly, a cancelled cheque does not require the account holder’s signature, making it a safe document for verification purposes in KYC, loan applications, and payment setups.

How to Cancel a Cheque

A cancelled cheque is often required for KYC verification, loan applications, or automatic payments. Follow these steps to cancel a cheque properly:

Step 1: Select an Unused Cheque

Choose a blank cheque from your chequebook that has not been filled out or signed.

Step 2: Draw Two Parallel Lines

Use a pen to draw two parallel lines across the cheque to indicate its cancellation.

Step 3: Write “CANCELLED” Clearly

Write “CANCELLED” in bold, capital letters between the parallel lines. This ensures clarity and prevents misuse.

Step 4: Leave Other Fields Blank

Do not write the payee’s name, amount, or signature. A cancelled cheque is only used for reference, not transactions.

Step 5: Ensure Essential Information Remains Visible

Keep the following details clear and readable:

-

Bank Name & Branch Address

-

Account Holder’s Name

-

Account Number

-

IFSC Code

-

MICR Code

Why is a Cancelled Cheque Needed?

A cancelled cheque is often used to verify your bank account details for:

-

Loan approvals

-

Insurance policies

-

Salary account setup

-

EMI or mutual fund payments

By following these steps, you can ensure that your cancelled cheque serves its purpose while keeping your banking details secure.

What is a Cancelled Cheque Used For?

A cancelled cheque is a cheque that has been crossed and marked as “cancelled,” making it invalid for transactions. However, it is important for verifying bank account details and authorizing financial processes.

Here are the key use cases for a cancelled cheque:

-

Bank Account Verification

Financial institutions require a cancelled cheque to verify bank account details when opening a new account, applying for loans, or setting up electronic fund transfers (EFTs). It helps banks and NBFCs authenticate your account information.

-

KYC Compliance

Cancelled cheques are crucial in Know Your Customer (KYC) verification for investments in mutual funds, stock markets, and financial schemes. Submitting a cancelled cheque online links your bank account to your investment portfolio, ensuring regulatory compliance and fraud prevention.

-

EPF Withdrawal

To withdraw funds from an Employee Provident Fund (EPF) account, a cancelled cheque is required to confirm the correct bank account for fund transfer.

-

Electronic Clearance Service (ECS)

For seamless automatic transactions, banks require a cancelled cheque to set up ECS. This allows businesses and individuals to authorize periodic fund transfers, such as salary payments, loan EMIs, and bill payments.

-

Automatic Bill Payments

A cancelled cheque is often required to set up recurring payments for utilities, subscriptions, insurance premiums, and other services, ensuring hassle-free auto-debit from your account.

-

Loan EMI Payments

When availing loans from banks or NBFCs, a cancelled cheque is needed to activate Equated Monthly Installments (EMIs). It authorizes automatic deductions, ensuring timely repayments.

-

Demat Account Setup

While opening a Demat account for stock trading, financial institutions require a cancelled cheque to verify your linked bank account for smooth fund transfers.

-

Insurance Policy Payments

Insurance providers request a cancelled cheque as proof of your bank account when processing premium payments and claim settlements.

Understanding the Risks Associated with a Cancelled Cheque

A cancelled cheque is a common requirement for financial transactions, including KYC verification, loan processing, and setting up automatic payments. While it cannot be used for direct transactions, it still contains sensitive information that could be misused if not handled carefully.

Potential Risks of a Cancelled Cheque

-

Identity Theft

A cancelled cheque displays key banking details such as your account number, IFSC code, and bank name. If it falls into the wrong hands, this information can be exploited for fraudulent activities, including unauthorized transactions or identity fraud.

-

Data Security Breaches

Even when shared with trusted institutions, your cheque details may be at risk if there is a security breach within the organization. Cybercriminals can access and misuse stored financial data, leading to financial losses.

-

Unauthorized Transactions

Though a cancelled cheque cannot be used for direct withdrawals, fraudsters may attempt unauthorized electronic transactions using the account details. Scammers might use this data to set up fake mandates or initiate unauthorized transfers.

How to Safeguard Your Cancelled Cheque

-

Limit unnecessary sharing: Only provide a cancelled cheque when necessary.

-

Mark it appropriately: Write “For KYC purpose only” or specify its intended use to prevent misuse.

-

Ensure secure storage: Avoid leaving cancelled cheques unattended and store them securely.

-

Monitor your account: Regularly review bank statements to detect any unauthorized activities.

Conclusion

Cancelled cheques play a crucial role in banking and financial processes but also expose sensitive information. By handling them securely and staying vigilant, you can protect your financial data from fraud and misuse. Always exercise caution when sharing banking details to ensure a safe and secure financial experience.

FAQ's

How to write cancelled cheque?

To write a cancelled cheque, take a blank cheque and draw two parallel lines across it diagonally. Then, write the word “CANCELLED” in capital letters between these lines. Make sure not to sign the cheque. This indicates that the cheque is void and cannot be used for any transactions, but it still serves as proof of your bank account details.

Is writing “Cancelled” on a cheque mandatory?

No, writing “Cancelled” on a cheque is not mandatory, but it is commonly required for verification purposes in financial transactions like KYC, loan applications, or opening a bank account.

Can a bank cancel my cheque?

Banks can cancel cheques upon a customer’s request, especially if a cheque is lost or stolen. This helps prevent unauthorized use and enhances security.

Can I sign a cancelled cheque?

Yes, you can sign a cancelled cheque, but it is unnecessary. Marking it as “CANCELLED” ensures it cannot be used for transactions.

What are the risks of a cancelled cheque?

A cancelled cheque contains sensitive banking details like account number, IFSC, and branch details. If not handled properly, it could be misused for fraudulent activities. Always ensure secure disposal if no longer needed.

Can I use red ink to cancel a cheque?

No, banks generally require black or blue ink to mark a cheque as cancelled for clarity and authenticity.

Can I block a cheque leaf online?

No, cheque leaves cannot be blocked online. You must manually write “CANCELLED” across the cheque to make it invalid for financial use.